Solvency II

RiskNews

RiskNews

ABI launches loss event database for insurers

LONDON – A new loss event database for insurance companies was launched at the end of September by the Association of British Insurers (ABI), in conjunction with software firm SAS.

Building a capital plan

Banks are required under Basel II to have a process in place for assessing their overall capital adequacy in relation to their risk profile. Bernard Manson and Christopher Hall outline how to construct a capital plan to ensure minimum capital…

Looking for clarity

The European Union's Markets in Financial Instruments Directive is set for implementation in April 2007. But there's plenty of confusion as to what the new regulations will entail – particularly with regards to 'best execution'. By Hann Ho

Under Scrutiny - Regulators focus on credit

Well-publicised risk issues and a recent growth spurt have brought credit markets firmly under the scrutiny of global regulators. Nikki Marmery investigates whether the attention will prove to be a boon for attracting more investment - or a barrier to…

Filling the ratings void

Unlike bond investors, structured products investors lack the benefit of industry-standard risk ratings. But with investors, IFAs and distributors all demanding change, Germany's investment banking industry, analytic firms and ratings agencies across…

Under Scrutiny - Regulators focus on credit

Regulation

European Parliament makes CRD law

COVER STORY

Looking for clarity

Compliance

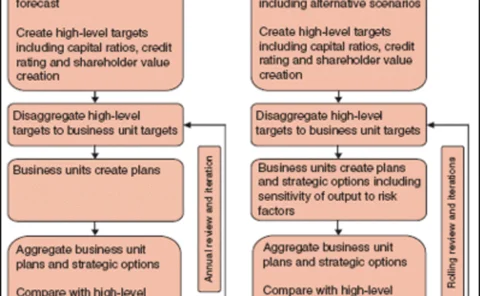

Building a capital plan

Basel II

RiskNews

RiskNews

Clearing the air

Emissions trading

Pillar II problems cause tempers to fray

LONDON – Tempers are continuing to boil over proposed Pillar II regulatory implementation, both in the industry and at the UK's Financial Services Authority (FSA). One attendee at the late July Pillar II standing group meeting described the event as …

Demanding disclosure

The dislocation in the correlation markets in May confirmed supervisors' fears about concentration risk in the hedge fund sector. And this is fuelling pressure for hedge funds to make more data disclosure. But how would this help to reduce risk? By…

Pillar II problems cause tempers to fray

REGULATORY UPDATE

Filling the ratings void

Cover story

Demanding disclosure

Hedge funds

CRO Forum study released

Industry body the Chief Risk Officer (CRO) Forum, which consists of the chief risk officers of Europe's leading insurers, is advancing the case for the use of proprietary internal models under Solvency II with the publication of a new in-depth report.

Briefs

REGULATORY UPDATE

FSA/CEBS co-ordination under fire

COVER STORY

Knocking down barriers

A new reinsurance directive passed by the European parliament in early June will eradicate the collateral requirements demanded by European supervisors. With a unified framework agreed for Europe, politicians are now turning their sights on the US. By…

A good time to build

US utilities may need to spend more than $100 billion in the next 25 years on new power plants and transmission capacity. Richard McMahon looks at how utilities are assessing long-term risks and attracting potential investors