Solvency II

Q&A: Karel Van Hulle on Solvency II delays and the challenges ahead

Beating the negative forces

‘Flawed’ standard formula currency risk calibration needs revision - Insurance Europe

Current specification is ‘counter-intuitive’, say industry experts

Solvency II set for inconsistent soft launch, lawyers warn

Absence of legal powers to enact guidelines in some jurisdictions threatens Eiopa’s objectives

Insurers fear non-recognition of equivalence under Solvency II interim reporting requirements

Group supervisors to determine whether European or local rules apply to non-European entities

Lloyd’s insurers challenged by internal model change policies

Questions on parameterisation remain unanswered by European rule-makers

Extensive reporting guidelines in Solvency II interim measures 'will challenge insurers'

Eiopa says measures will help supervisors and insurers prepare for Solvency II

Italian insurers question benefit of Solvency II long-term guarantees package

Matching adjustment and countercyclical premium inadequate for Italian insurers’ needs

Solvency II equivalence rules must not threaten European insurers - Skinner

Rules must not cause 'ill effects' to firms with international business, warns senior MEP

Insurers struggle with ‘ambiguous’ technical specifications for long-term guarantees exercise

Difficulty interpreting rules threatens usefulness of results to policy-makers

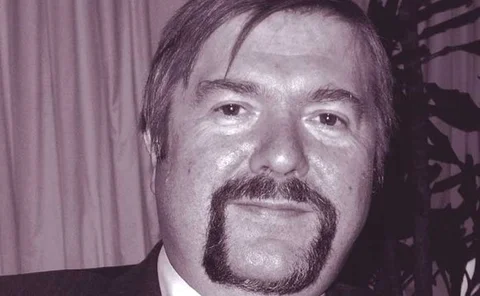

Commission's Van Hulle to be succeeded by procurement lawyer

European Commission confirms new head of insurance and pensions unit

Matching adjustment ring-fencing provisions ‘a threat’ to mutual insurers

Provisions would prevent common funds structures and reduce diversification benefits, say insurers

Swedish Solvency II discount rate move 'must address sensitivity concerns'

Extrapolation methodology must be robust and allow insurers to manage solvency positions, says Insurance Sweden

Hedge funds grapple with Solvency II look-through test

Clear and present data

Bridging the gap: Solvency II phase-in troubles insurers

Proposed interim measures hope to bring some regulatory consistency across Europe in the period prior to Solvency II’s eventual implementation, but supervisors are still seeking their own solutions, while insurers warn that any interim measures must not…

Insurers raise fresh concerns over Solvency II phase-in

Instability of capital framework should be reflected in plans for soft-launch

Solvency II transitional measures come under fire

Concerns about costs and suitability of phase-in of capital charges

Solvency II capital tests not part of augmented Icas regime, FSA confirms

Insurers welcome Icas+, although uncertainty remains over future requirements

Concerns over restrictions in matching adjustment assessment

Long-term guarantees impact assessment begins, but 'disappointment' over narrow eligible assets for matching adjustment

New risk-free rate calculation for long-term guarantees test

Higher credit risk adjustment to reflect current market conditions

The question is not when Solvency II will come into effect, but in what form

The question is not when Solvency II will come into effect, but in what form

Lawyers question Eiopa’s powers to soft-launch Solvency II

Authority promises guidelines on early implementation of risk governance and Orsa rules, but some doubt remains

Long-term guarantees test specifications to be published on test launch day

Fears that delay in releasing specifications will lead to inaccurate results

Insurers grapple with Solvency II economic capital projections

Capital projection

Lack of clarity on calculation parameters jeopardises long-term guarantees test

Concerns that technical specifications may be released only days before assessment is launched