Europe

Buffer stops? Why banks haven’t used Covid capital relief

Amid weak credit demand, banks haven’t availed themselves of capital buffers, but they still might

€STR transition stymied by addiction to Eonia – ECB

Notional outstanding OIS referencing outgoing rate has increased year-to-date

Capital cliff effect awaits EU banks as Covid support wanes

CET1 ratios have benefited from state intervention, but could drop sharply as measures expire

Esma warns of UK-sized hole in Europe’s fund leverage radar

Executive at hedge fund AQR also urges reform of EU leverage measures to better assess risk

European banks want clarity on post-Covid capital rebuild

Supervisors urged to explain what will happen when pandemic relief on capital buffers expires

Weak EU banks may lowball Covid loan losses – ECB

Low-profitability banks provision less than their more flush counterparts

EU Covid policies resurrect sovereign doom loop fears

Italian banks could see holdings of home country debt increase to 17% of their total assets

State-backed Covid loans have light capital impact – EBA

Average risk density of guaranteed loans was 18% at end-June

EU loans under Covid moratoria have high credit risk – EBA

Banks in Austria, Iceland, Romania and Slovakia especially vulnerable, data shows

Synthetic Libor powers give FCA ‘massive discretion’

Consultation on use of new benchmark clout may not limit safety-net rates to economic realities

Isda study reveals size of Covid’s trading book capital hike

Procyclicality led to aggregate 25% rise in market, CVA risk-weighted assets

Regulators’ margin model rules too lax – BlackRock exec

Risk USA: EU anti-procyclicality rules like “putting a curtain over a draughty window”

Banks in EU periphery lose most on soured loans

Irish, Spanish, Italian banks also have to wait longest to recover loaned funds to borrowers in default

UBS gears up for another tilt at clearing

Swiss bank makes senior hires and upgrades tech platform ahead of Brexit and leverage offset

EU’s dividend ban overshadows reform effort

Banks may be reluctant to run down buffers even if regulators soften the MDA threshold for payouts

EU funds lack liquidity management tools – Esma

Most Ucits can only rely on temporary borrowing or gating to weather crises

November 9: the day the Brexodus started?

The UK Treasury’s equivalence verdict is a positive gesture, but could backfire if not reciprocated

Mixed response to Esma’s clearing carve-out for optimisation

Long-awaited proposal must be replicated by US and UK to be effective, participants say

How low can you go: falling cost of FX fix sparks concern

Algorithms reducing fixing fees, but some dealers willing to go even lower – perhaps dangerously so

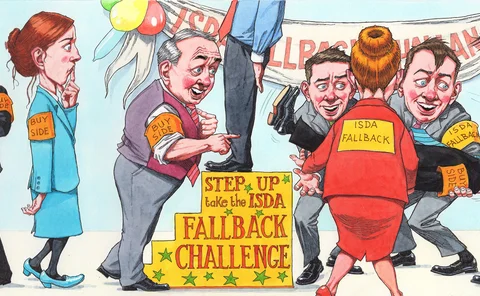

The buy side and Libor: it’s decision time

Investors weigh pros and cons of signing newly released Isda fallback protocol, as Libor demise looms

Loan-loss provisions take a smaller bite out of EU banks in Q3

Set-asides fell 57% quarter on quarter

SME risks take centre stage at European banks

Lenders could suffer if government support for small business starts to wane

EBA wants Basel to revisit prudential rules on software

Banking regulator set to soften capital impact of IT assets, but proposals are still out of line with US

French rivals BPCE, SocGen see market risks fall in Q3

Market RWAs drop 24% at SocGen quarter on quarter