Europe

Firms doubt benefits of EU Mifid best execution reform

Esma proposal retains unpopular aggregated reporting; bankers want more cost-benefit analysis

Cyber optics: are banks downplaying SolarWinds hack?

In wake of watershed breach, banks eye supply chain risk while talking down hack’s impact

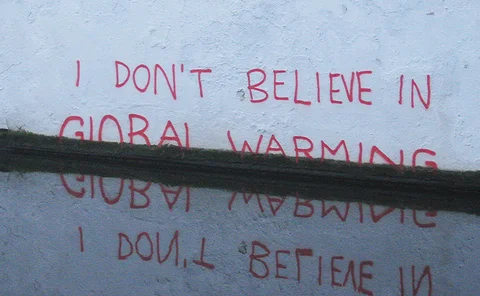

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

EC aims for near-real-time consolidated tape

Exchanges say the plan is too ambitious and would trigger a latency arms race

Weather, or not: is climate risk just part of credit risk?

Practitioners divided on whether climate risk can fit into existing credit risk weights

EU consolidated bond tape could boost all-to-all trading

Greater confidence in pricing may also have eased Covid liquidity crunch, says Dimensional exec

Basel III output floor set to bind 25% of large banks

Risk-based capital requirements would constrain the largest share of international lenders

EC shelves report on relocation of euro clearing

Consultation revealed a deep reluctance among banks to shift clearing to EU CCPs

European banks set for 17.6% capital hike under Basel III

Output floor expected to push Tier 1 capital requirements up 7.3% alone, latest BCBS monitoring report shows

Inflation swap stampede stirs fears of lopsided market

Soaring demand for inflation hedges leaves dealers struggling to balance exposure

State Street launches tri-party custody for IM clients

Third-party provider begins shifting phase five clients to full-service collateral model

Banks warn it’s too early for an OTC swaps consolidated tape

Market participants say Isin difficulties need to be resolved in order to create a usable tape

Equity derivatives house of the year: BNP Paribas

Asia Risk Awards 2021

OTC trading platform of the year: Tradeweb

Asia Risk Awards 2021

Phase five margin queues spur calls for custody revamp

Custodians urged to update “antiquated technology” ahead of three-fold jump in phase six initial margin onboarding

BNP Paribas leads EU banks on repo exposures

French bank increased securities financing transactions by €66bn in the first half of the year, the most among the bloc’s top lenders

Bank-backed futures utility criticised as too ambitious

Osttra’s Joanna Davies urges industry to look for “quick wins”

Euro swaps relocation stalls as equivalence deadline nears

Nine months before equivalence deadline, over 70% of EU euro swap trades still clear in the UK

House of the year, Hong Kong: Crédit Agricole

Asia Risk Awards 2021

EC expected to apply output floor at group level only

‘Parallel stacks’ proposal unlikely to appear in first draft of CRR III, due next month

Default risk set to rise from climate inaction – ECB

‘Hothouse world’ scenario could see average probability of default increase significantly more than under both orderly or belated transition

Study fuels doubt over benefits of climate risk-weights

Research finds both green supporting factor and carbon penalising factor have drawbacks

Santander’s CVA charge jumps 94% in Q2

Among the other EU systemic banks, higher capital requirements also at SocGen, ING, Crédit Agricole and UniCredit

Bank consortium seeks to cure post-trade data ills

Project led by Societe Generale uses privacy-enhancing technologies to tackle data management problems