Profile

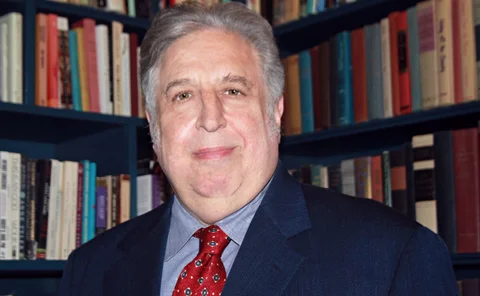

Caveat pre-emptor: Man ESG chief talks snubbed markets

Robert Furdak is sparking discussions about responsible trend following in unsustainable stocks

How Onyx came from nowhere to conquer oil swaps

In just four years, market-maker has become the largest provider of liquidity in energy derivatives

Neuberger Berman gets its Sherlock on

Asset manager deploys quant-cum-sleuth to sniff out portfolio risk

Bank disruptors: Crédit Ag taps AI to lure swaptions business

Machine learning model predicts client demand with high accuracy, giving traders an edge in pricing

Bank disruptors: JP Morgan smashes silos

To foster innovation, the US banking giant rebuilds its culture by breaking boundaries

Bank disruptors: BofA’s ‘citizen devs’ take on innovation mantle

Central data and technology group enables frontline ‘citizen developers’

Bank disruptors: a ‘token’ effort from UBS

The utility settlement coin will kick-start trading of digital assets, says Chris Purves

Bank disruptors: how tech joint ventures help Nomura’s bottom line

Nomura is developing new software services to supplement trading profits

Bank disruptors: SocGen’s call to start-ups

Fintechs and ‘intrapreneurs’ are leading Societe Generale’s digital transformation

Haitong taps NLP to inform collateral coverage

Hong Kong broker scours news and blogs in bid for better corporate signals in China’s opaque markets

Bank disruptors: Barclays finds blockchain nirvana

USC could transform financial markets. But first, backers must prove it is secure

Esma trains beam on investment fund risks

Officials look to regulatory reporting for better grasp of fund leverage and liquidity

On eve of Brexit, PPF’s chief risk officer isn’t too worried

Stephen Wilcox talks about getting pensions paid without the benefit of controlling ‘UK Plc’

Ex-Credit Suisse quants embrace machine learning

Founders of XAI Asset Management grapple with unsupervised learning and the problems of explainability

Ready or not – a low-carbon economy is coming

Government and business must avert disorderly move away from fossil fuels, says Geneva Association’s Maryam Golnaraghi

A new leaf: why a hedge fund manager bought a bank

Andy Redleaf founded a $6 billion hedge fund. Now he runs a small community bank

Dark materials: how one academic is delving into data

David Hand shines a light on dark data and the dangers of distortion by absence

Intercept: AQR’s risk-catching machine

CRO Mike Patchen has helped build a system to identify risks before they grow or spread

Stock-picking finds unlikely champion in ex-Winton CIO

Matthew Beddall’s Havelock restyles value investing for the big data age

Tradeweb’s IPO shows how OTC markets are changing

RFQ pioneer is embracing new protocols and liquidity providers in a bid to connect the OTC markets

Eastspring seeks to nurture growth with better data

Data mapping key to asset manager’s plans as parent pivots to Asia

Keeping watch: EBA stress-testing head plans overhaul

Top-down approach, dynamic balance sheet and multiple shock scenarios all possible for 2022

The greening of Natixis’s balance sheet

Green weighting factor will be used to adjust the credit RWAs of loans

At bounding MarketAxess platform, a new CRO parses risk

Clarity and communication are basics to Oliver Huggins at one of the biggest US bond platforms