Profile

Barclays confronts ‘implausible’ macro risks

Talking Heads 2022: Bank is reaping rewards of sticking with its trading businesses, says macro head Lublinsky

Goldman’s rates traders have been crowd-watching

Talking Heads 2022: Steepener unwinds in sterling were “canary in the coalmine”, says rates trading co-head

How Citi is handling topsy-turvy rates markets

Talking Heads 2022: Rate hikes and inflation have forced a rethink of the US bank’s hedging strategies

This time’s no different: Robeco’s faith in 200-year backtests

Firm’s (very) long-term studies suggest factor strategies can soften hit from stagflation

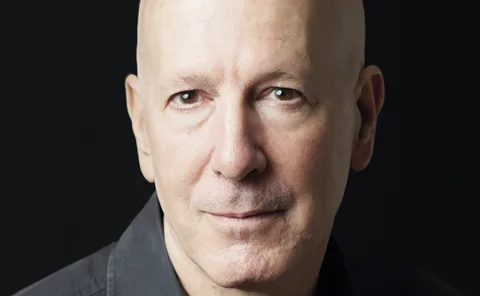

How Michael Spector left his mark on quantitative finance

Physicist trained in Soviet scientific centres found elegant solutions to complex problems

Sell side ramps up outsourced trading to sceptical buy side

New entrants anticipate a wave of takeup among larger asset managers, but are they aiming too high?

‘Corrective’ algo tells quant firm when it’s wrong

QTS has built a machine to show whether a strategy is likely to succeed or flop

Federated’s CIO on the fight to save prime MMFs

SEC reform proposal could be final nail in coffin for institutional prime funds

From ‘cottage industry’ to quant-ready: prop data at JP Morgan

Unique information now “table stakes” for brokers as they compete for new clients

Carbon fund increases returns by decreasing supply of permits

Europe’s emissions trading system could be a catalyst for the energy transition, but only if prices rise

Optiver aims to gatecrash FX options private party

Dutch non-bank hopes to exploit shift to electronic markets in OTC options, following record $7bn trading day

New GFXC chair aims to keep up reform on last look

SNB’s Andrea Maechler urges more liquidity providers and trading venues to address hold times

Benhart: banks should start revising for OCC’s climate exams

US agency’s climate chief says firms will need more data from clients if they’re to make the grade

Bookstaber: past performance is no guide to future risks

Veteran risk chief says trading gains in wake of LTCM’s demise forged love of agent-based modelling

Adia wealth fund is building supergroup of quant investing

Abu Dhabi Investment Authority wants to turn systematic investing into a ‘good science’

How NN IP uses machines to read the market – and itself

Dutch manager being acquired by Goldman uses machine learning to ‘augment’ its analysts

Back in the New York groove: BNY CRO’s risk revamp

Veteran risk manager and former trader on “intelligent” risk-taking

Rising inflation may spare smaller middle-market lenders

PennantPark bets that picking the right entrepreneur can protect private credit from rising prices

How State Street came to vote against polluting companies

SSGA will vote against companies that do too little on climate, but won’t abandon them entirely

NatWest’s PB chief on not changing course after Archegos

Marcus Butt believes diversity of clients, both in size and type, is the best way to manage risk

A quant’s view on protecting stock-pickers from themselves

Ex-Citadel, Millennium risk manager says fundamental investors have much still to improve

How Brexit split Aegon’s euro swaps book

Years-long effort saw trades quietly move to Frankfurt – but firm wants continued access to LCH

Mizuho tries its hand in European rates

Japanese bank bets on handful of deep relationships to compete in crowded European market

Stronger together: CLS’s chief risk officer on risk culture

Deborah Hrvatin discusses integrated risk management, mega-hacks and model risk