US Department of the Treasury

Fatca delay simply “smoke and mirrors”

Moves by US authorities to delay implementation of portions of Fatca provide little relief for institutions

Volcker rule could hurt liquidity in FX spot market, participants warn

Foreign exchange swaps and forwards should be exempted from the Dodd-Frank ban on prop trading, or else liquidity in the spot market could suffer, industry participants say

Europe gets long and short ETFs on US and UK sovereign debt, with leverage

The first exchange-traded funds to offer daily leveraged exposure to US and UK sovereign debt have been listed in Europe

US Treasury’s FX exemption hangs in the balance

A year after the US Treasury's proposed regulatory exemption for FX swaps and forwards, the position has never been confirmed - and some believe it may be reconsidered

Tri-party repo taskforce to disband without delivering key reform

The New York Fed's concerns about intra-day credit should be tackled by JP Morgan, BNY Mellon and DTCC, an industry taskforce concludes

Draft Fatca regulations will include reciprocity, experts say

Industry experts say Fatca draft regulations are likely to include reciprocity elements

Bank risk manager of the year: JP Morgan

Risk awards 2012

Delayed Fatca regulations look set to ignore 'passthru' payments

Further uncertainty expected by the industry once delayed draft Fatca regulations are released

Amir-Mokri appointed to US Treasury

Cyrus Amir-Mokri is the new assistant secretary for financial institutions at the US Treasury.

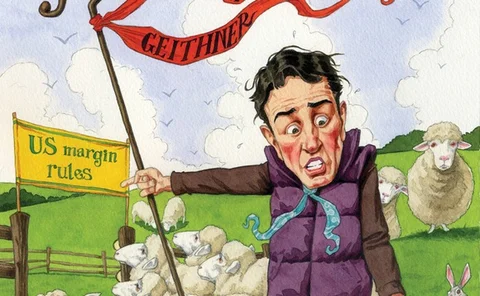

Foreign regulators leave US isolated on uncleared margin rules

Follow the leader?

Sponsored statement: MarketAxess

Fixed income e-trading trends: The ripple effect of new financial markets regulation

US Treasury lifts sanctions on Libyan oil subsidiaries

OFAC removes ban on transactions with several Libyan oil company subsidiaries

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

NYSE Liffe: one pot to rule them all

One pot to rule them all

Bond stars scrap shorts on US treasuries as yields plunge

Old Mutual and Legal & General managers say the time is right for a shift, while Artemis's Littlewood disagrees

US tax fix smoothes way for back-loading buy-side portfolios

US tax fix to aid buy-side portfolio back-loading

European Parliament rejects Swinburne’s forex exemption

Crucial plenary vote on Emir on July 5 retains suggested amendments to recognise unique nature of FX derivatives, but strips out explicit calls for an exemption

Australian regulators suggest clearing exemption for foreign exchange

Reserve Bank of Australia discussion paper commits to harmonising rules with US and Europe

Geithner letter to Hungarian minister weighs in on Emir open access debate

Market participants believe US letter endorses a narrowing of Emir scope, but a Treasury official says the letter draws attention to gap in regulation

Arguments against forex clearing flawed, says Duffie

Foreign exchange forwards and swaps should be cleared under Dodd-Frank despite industry reservations

FXall looks to Sef licence to boost liquidity

FXall chief executive Phil Weisberg suggests banks might choose to outsource some elements of their single-dealer business to multibank platforms when Dodd-Frank Sef rules become binding

Exemption clarity allows market participants to prepare for new regime

Banks, market infrastructures and industry associations prepare to move forward with regulatory preparation, now that fx swaps and forwards are set to be exempt

Index innovation of the year

Index innovation of the year