Securities and Exchange Commission (SEC)

Faith shaky as market awaits flash crash report

Mutual funds pulling money out of US stocks amid fears of gaming by HFT investors

People moves in the op risk industry

Changing Hats

New Jersey adviser charged with multimillion-dollar fraud

New Jersey adviser charged with multimillion-dollar fraud

US SEC and Citigroup defend $75 million subprime settlement

US SEC and Citigroup defend $75 million subprime settlement

UK FSA hits Goldman Sachs with £17.5 million reporting fine

UK FSA hits Goldman Sachs with £17.5 million reporting fine

Cost of op risk failings rising

Outlook: fines

Goldman Sachs hit by £17.5m reporting fine

Bank to pay UK regulator for failing to disclose SEC investigation

SEC mandate over rating agencies strengthened by Dodd-Frank

Closure of SEC investigation into Moody's demonstration of the regulator's new powers under Dodd-Frank

Market awaits details on SEFs

Keeping on top of the swaps

Dodd-Frank sees processing firm as 'swap execution facility'

Markit/DTCC joint venture will register as designated swap execution facility under US financial reform, despite having no plans for trade execution

Dodd-Frank: devil is in the detail on bonus transparency requirements

US banks must consider disclosure rules for CEO and median pay packages

Dodd-Frank sends banks on journey into the great unknown

The passing of the Dodd-Frank Act into US law signifies profound changes for banks and regulators. But how they should prepare now for the new legislation is still far from certain

HSBC faces money-laundering investigations by US regulators

Admits is is likely to face enforcement action

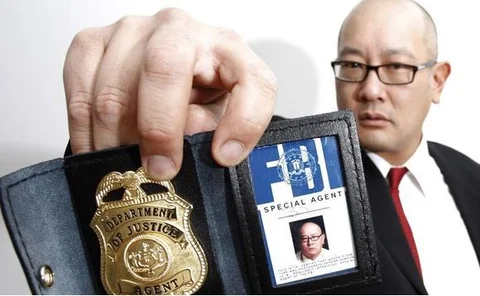

Ramsay named as SEC trading and markets deputy

US Securities and Exchange Commission appoints replacement for Gallagher

Regulators kick off derivatives reform discussion

Market participants call for clearing decisions to be left to market forces and caution regulators about clearing house ownership

FDIC creates new units as US regulators expand for Dodd-Frank systemic oversight

US regulators are hiring more staff in preparation for Dodd-Frank changes

Singapore bids to be Asian derivatives and clearing hub

Asian migration

Flash crash lessons learned: Interview with Bannert-Thurner

Now that the dust has settled after the extraordinary May 6 ‘Flash Crash’, Victor Anderson catches up with FTEN’s Valerie Bannert-Thurner to discuss how technology can help guard against future crises

Clearing dilemma for CCPs

Dealers have made progress towards clearing swaths of the over-the-counter derivatives market. But market participants are likely to have to clear more awkward products to satisfy regulators’ demands. Mark Pengelly investigates

Dodd-Frank Act signed but uncertainty remains

New legislation means more study and rule-makings needed, creating operational risks for banks

Goldman Sachs to pay $550 million to settle SEC lawsuit

US bank receives the largest fine the SEC has ever imposed on a financial entity

Partially protected: Dodd-Frank Act spares structured products

Registered advantages

Liquidity critical to OTC clearing, argue dealers

Regulators should consider liquidity when deciding which over-the-counter derivatives should be cleared, say market participants

Dealer-led market may be disrupted by Dodd-Frank

Banks could lose margins and competitive edge as a result of derivatives reforms in Dodd-Frank Act