Morgan Stanley

Wells Fargo’s off-balance-sheet exposures up $54bn

Total OBS exposures across the US largest systemically important institutions hit $3.04trn in Q1

Fed casts doubt on future of Basel internal models in US

Banks warn Fed cannot keep commitment to avoid Basel III capital hike if it forbids models

US banks add $130bn in carve-out assets as SLR relief ends

JP Morgan led the top US banks in increasing their stock of US Treasuries and excess reserves

Quant fund aims to tame bitcoin, and 39 other digital assets

Ex-Morgan Stanley, Winton vets reimagine institutional risk management for volatile crypto markets

JPM records highest number of profit-making days in six years

In aggregate, US G-Sibs racked up 355 profit-making days over Q1

Morgan Stanley, Bank of America push VAR limits the most

Largest losses-to-VAR ratios at the two firms were the highest among the eight systemic US banks in Q1

Goldman’s market RWAs grew $14.9 billion in Q1

The increase was largely due to higher VAR and SVAR measures

RWA density rises at Citi, BNY Mellon and State Street

The eight US G-Sibs reported total assets of $14.2 trillion, up 5% quarter on quarter

How Credit Suisse fell victim to its own success

Roots of Archegos loss can be traced to business strategy the bank embraced back in 2006

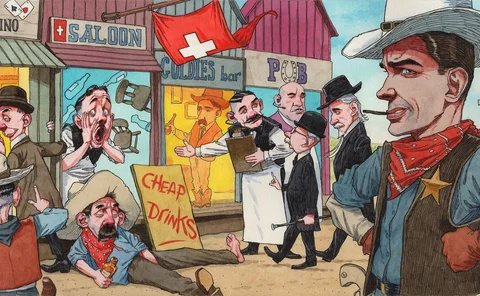

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Goldman’s swaps clearing unit boosts client margin by $1.2bn

The top eight FCMs accounted for 95.8% of total client required margin, down 96.4% YoY

People moves: senior swaps at HSBC, new CEO for Nomura, and more

Latest job changes across the industry

Who wants to buy US Treasuries?

Federal Reserve’s journey to tapering will be paved with volatility and weaker demand

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

Energy Risk Commodity Rankings: firms provide a lifeline in choppy waters

Winners of the 2021 Energy Risk Commodity Rankings supported clients in unprecedented times to be voted counterparties of choice

UBS Apac sales structuring exec to join Morgan Stanley

Bilal Al-Ali to head Apac structured sales at the US bank

Systemic US banks released $9.4bn of credit reserves in Q1

JP Morgan reversed $4.2 billion of provisions alone

Morgan Stanley’s VAR hit eight-year high in Q1

High risk-of-loss indicator coincides with Archegos collapse

Would margin rules have checked Archegos? Perhaps not

Regulator-prescribed margin methodology permits six-times leverage on equity swaps

Level 3 assets at US banks grew 13% in 2020

Citi posted an 100% increase over the year to $16.1 billion

What good are risk disclosures anyway?

Regulatory filings and shareholder reports offered no heads-up of Archegos’ troubles

Goldman, Morgan Stanley led US dealers on equity swaps in 2020

Overall equity derivatives notionals at Goldman hit $2.08 trillion at end-2020

Derivatives notionals at Wells Fargo, BofA fell in 2020

Written options notionals dropped 12% in aggregate

Top US banks to lose out from end of SLR relief

Average G-Sib will see SLR decline 90 basis points using Q4 2020 figures