Japan Securities Clearing Corporation (JSCC)

Sovereign bonds top choice for IM collateral

Drive towards higher interest-earning assets strongest at CME and LCH among top CCPs

Ice Credit makes biggest IM call since early pandemic

Aggregate peak calls were 17% higher in Q1 than previous quarter across 25 clearing houses

CCPs shun central banks in liquidity buffers rejig

LCH, Ice US and CME lead the way towards commercial banks

Hedge funds boost new Tona futures market

Arbitrageurs said to be behind early trading as contracts tipped to prove useful for US buy-siders

Initial margin breaches surge at JSCC government bonds division

Sharp interest rate fluctuations triggers largest backtesting deficiency on record

Swap Connect shines light on US client clearing hurdles

New scheme may intensify calls for CFTC to reassess its exempt DCO limitations

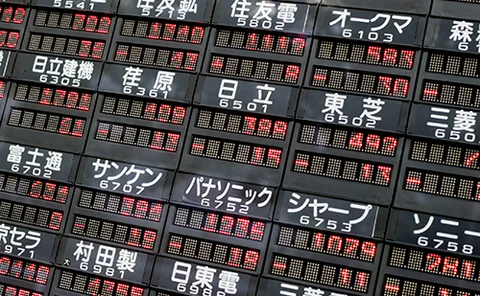

JSCC and the future of clearing and settling yen-denominated trades

The Japanese Securities Clearing Corporation (JSCC) explores how market participants can benefit from a wide array of yen products while accessing robust risk and margin management frameworks with a high level of transparency

Behnam comments fan JSCC hopes for US client clearing

Japan clearing exec welcomes CFTC chair’s pledge to keep discussing OTC clearing status for non-US houses

CCP ‘skin in the game’ still dwarfed by member contributions

Even as markets churned in 2022, clearing houses coughed up only 2% of funds at end-September – the same as the previous year

Commercial bank cash grows more popular for initial margin

Shift driven by Ice Europe as CCPs diverge on preferred type of collateral

EU and UK CCPs dominated by foreign members

Non-domestic clearing members accounted for over 70% of LCH’s and Eurex’s pool in Q3

CCPs’ largest members account for almost half IM

Analysis of 30 clearing services shows wide dispersion in concentration risk – with LCH and JSCC leading the pack

LCH Japan plan signals new fight for global clearing model

UK-based clearing house faces “uphill struggle” against JFSA location policy on yen derivatives

JSCC’s bond and IRS units hit by almost 200 breaches

Q2 volatility triggered some of the largest initial margin breaches ever reported by the CCP

At JSCC, required initial margin up 20% in Q1

The bulk of the increase came from members of the clearing service covering ETPs

JSCC swap surge triggers plea to rethink US client ban

With over two-thirds of yen RFR swaps volumes going to JSCC, calls grow for CFTC to ease clearing restrictions

Legacy Libor swaptions face day of reckoning

Holders of physically settled swaptions in sterling and yen must switch to new risk-free rates, but it’s not simple

Dealers slam alternative for Tibor Tokyo swap rate

Refinitiv activates synthetic version, but TSR’s cessation is on hold pending further consultation

Liquidity risk rose at most CCPs in Q3

JSCC, CME, Ice and Eurex among those that revised their VM estimates

JSCC member received $3bn cash call in Q3

The CCP revised its estimate of the worst-case payment obligation that would have to be met should one of its participants collapse

CCPs’ successful Libor switch raises hopes for sterling move

Optimism follows hitch-free conversion of cleared yen, Swiss franc and euro Libor swaps to RFRs

Clearing house of the year: JSCC

Asia Risk Awards 2021

JSCC turns to commercial banks in rejig of liquidity reserves

Funds stashed at the Bank of Japan down 31% on the previous quarter

Swaptions get fallback safety net, but crave CCP fix

Isda’s Ice swap rate fallbacks calm fears, yet CCP action needed to protect physical settlement