International Monetary Fund (IMF)

FSB exec dismisses leverage cap proposals for NBFIs

Tackling excessive leverage requires a nuanced approach instead of a broad cap, says Martin Moloney

Boaz Weinstein picks Ukraine bonds as a tail-risk strategy

Saba Capital bought debt for as little as 20 cents on the dollar, anticipating explosive payoff

Facebook’s libra could disrupt collateral markets – IMF paper

Collateral used to back ‘stablecoins’ such as libra will be unavailable for reuse

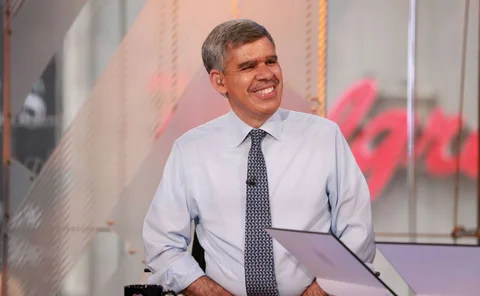

El-Erian on Covid-19 policy risks and central bank capture

Former Pimco chief says Fed has gone too far, market function rules needed and chance opens for shared policy load

Leverage is underestimated

Off-balance sheet funding is large, rising and not fully accounted for in leverage metrics

Sovereign risk manager of the year: Senegal’s Ministry of Finance and Budget

Risk Awards 2020: ADB guarantee cuts swap costs by 500bp, opening the door for a $1.4b forex hedge

Post-crisis rules roil US cross-currency basis – IMF

EU leverage ratio causes basis spikes at quarter-ends

How collateral scarcity reshaped the US yield curve

QE and demand for high-quality liquid assets have suppressed short-term rates, argue IMF economists

Gaps emerge in US plan to regulate non-bank systemic risk

Former regulators say FSOC may struggle to measure systemic risk in repo, loan markets

Malta’s crypto assets plan means greater AML risks, IMF warns

Authorities must rapidly improve AML regime and guarantee FSA’s independence, mission says

The foreshocks of Brexit

As Brexit chaos continues, energy firms and traders are upping sticks and leaving the UK

Regulatory merger keeps China on course for deleveraging

Combination of banking and insurance regulators offers opportunity to co-ordinate debt reduction measures

Sovereign risk manager of the year: Debt Management Office of Saudi Arabia

Risk Awards 2018: New DMO is building a benchmark curve that could spur local capital markets

Sifi snafu: Deutsche's cautionary tale

Subjecting big firms to tougher regulation is sensible in principle but difficult in practice

Fishing for Sifis: row over Nobel laureate’s risk model

Engle’s tool for ranking risky firms is one of many that are dividing industry, academics and regulators

IMF's systemic risk findings called into question

Financial connectedness measure “not usually sharply aligned with systemic risk”, says Darrell Duffie

Risk, AML fears hitting Arab correspondent banking

“De-risking” cited most often as key factor behind trend

Central banks must be 'market-makers of last resort' – IMF

Monetary policy and regulation have amplified illiquidity, says IMF official

Belgian regulator defends structured products moratorium

Watchdog claims complex products sale ban winning plaudits as soft-hands approach

ETF and mutual fund liquidity present risks to investors

IMF argues redemption policy regulation should address illiquid assets

‘Grexit’ and radical Greek bond restructuring not expected

Extension of maturities and lower interest rates more likely