Goldman Sachs

Fed stress tests stretch Goldman Sachs, HSBC

US dealers toe binding minimums in latest DFAST exercise

Assets under custody creep up at BNY, JP and State Street

Across the eight US systemically important banks, custody assets rose 27% year on year

JP Morgan, BofA face higher G-Sib surcharges

Both banks could face an extra 50 basis points of capital add-on without remedial action

Banks invest in futures utility to guard against tech snafus

FCMs, including Goldman and JP, stump up $44 million to fund FIA Tech push to standardise trade processing

Bank of America cleared swaps jump $6.6trn

Bank’s quarterly increase leads US G-Sibs’ $25trn rise in Q1

People moves: five leave JP Morgan, MS names co-presidents, and more

Latest job changes across the industry

Wells Fargo’s off-balance-sheet exposures up $54bn

Total OBS exposures across the US largest systemically important institutions hit $3.04trn in Q1

The new rules of market risk management

Amid 2020’s Covid-19-related market turmoil – with volatility and value-at-risk (VAR) measures soaring – some of the world’s largest investment banks took advantage of the extraordinary conditions to notch up record trading revenues. In a recent Risk.net…

US banks add $130bn in carve-out assets as SLR relief ends

JP Morgan led the top US banks in increasing their stock of US Treasuries and excess reserves

JPM records highest number of profit-making days in six years

In aggregate, US G-Sibs racked up 355 profit-making days over Q1

Morgan Stanley, Bank of America push VAR limits the most

Largest losses-to-VAR ratios at the two firms were the highest among the eight systemic US banks in Q1

Goldman’s market RWAs grew $14.9 billion in Q1

The increase was largely due to higher VAR and SVAR measures

RWA density rises at Citi, BNY Mellon and State Street

The eight US G-Sibs reported total assets of $14.2 trillion, up 5% quarter on quarter

Goldman inks modelling, data tie-up with MSCI

Move to cross-sell risk analytics could herald further content deals for bank’s Marquee platform, says sales chief

How Credit Suisse fell victim to its own success

Roots of Archegos loss can be traced to business strategy the bank embraced back in 2006

Prudential, Goldman cast doubt on Libor-like replacement rates

Isda AGM: Participants split on case for credit-sensitive rates in post-Libor world

Accurate RFR hedges face liquidity trade-off, participants say

Isda AGM: Aligning swaps with assorted cash market conventions requires users to weigh liquidity cost

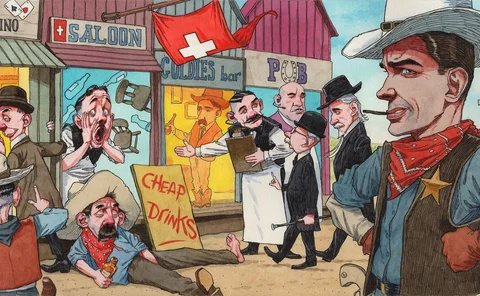

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Goldman’s swaps clearing unit boosts client margin by $1.2bn

The top eight FCMs accounted for 95.8% of total client required margin, down 96.4% YoY

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

Systemic US banks released $9.4bn of credit reserves in Q1

JP Morgan reversed $4.2 billion of provisions alone

Modifying market risk management – A year into the Covid‑19 pandemic

This webinar explores how capital markets participants revised their market risk management practices during the height of Covid-19 pandemic-induced market volatility and what this means for the future

JP Morgan’s SLR falls as Fed relief ends

Bank says raising capital against deposits are “unnatural actions for banks”

Would margin rules have checked Archegos? Perhaps not

Regulator-prescribed margin methodology permits six-times leverage on equity swaps