Goldman Sachs

Goldman’s market RWAs grew $14.9 billion in Q1

The increase was largely due to higher VAR and SVAR measures

RWA density rises at Citi, BNY Mellon and State Street

The eight US G-Sibs reported total assets of $14.2 trillion, up 5% quarter on quarter

Goldman inks modelling, data tie-up with MSCI

Move to cross-sell risk analytics could herald further content deals for bank’s Marquee platform, says sales chief

How Credit Suisse fell victim to its own success

Roots of Archegos loss can be traced to business strategy the bank embraced back in 2006

Prudential, Goldman cast doubt on Libor-like replacement rates

Isda AGM: Participants split on case for credit-sensitive rates in post-Libor world

Accurate RFR hedges face liquidity trade-off, participants say

Isda AGM: Aligning swaps with assorted cash market conventions requires users to weigh liquidity cost

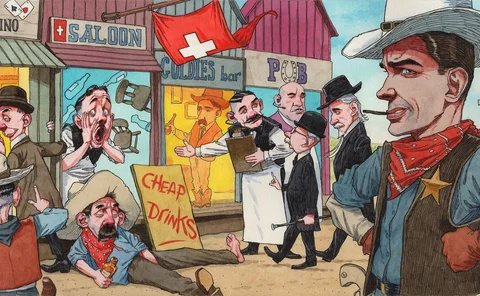

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Goldman’s swaps clearing unit boosts client margin by $1.2bn

The top eight FCMs accounted for 95.8% of total client required margin, down 96.4% YoY

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

Systemic US banks released $9.4bn of credit reserves in Q1

JP Morgan reversed $4.2 billion of provisions alone

Modifying market risk management – A year into the Covid‑19 pandemic

This webinar explores how capital markets participants revised their market risk management practices during the height of Covid-19 pandemic-induced market volatility and what this means for the future

JP Morgan’s SLR falls as Fed relief ends

Bank says raising capital against deposits are “unnatural actions for banks”

Would margin rules have checked Archegos? Perhaps not

Regulator-prescribed margin methodology permits six-times leverage on equity swaps

Level 3 assets at US banks grew 13% in 2020

Citi posted an 100% increase over the year to $16.1 billion

What good are risk disclosures anyway?

Regulatory filings and shareholder reports offered no heads-up of Archegos’ troubles

Goldman, Morgan Stanley led US dealers on equity swaps in 2020

Overall equity derivatives notionals at Goldman hit $2.08 trillion at end-2020

Hong Kong banks await guidance on IRRBB for risk-free rates

HKMA will steer how historical volatility data can be used for valuing new options contracts

Derivatives notionals at Wells Fargo, BofA fell in 2020

Written options notionals dropped 12% in aggregate

Top US banks to lose out from end of SLR relief

Average G-Sib will see SLR decline 90 basis points using Q4 2020 figures

Deposits boosted top US banks’ short-term funds in 2020

Unsecured funding from outside the financial sector increased 22% to $934.6 billion

Op risk data: Pandemic paradox of low, low losses

Also: Navient gets schooled for scam; Amex holiday let-down; BNL’s Italian Job hit. Data by ORX News

Five US systemic banks face higher G-Sib surcharges

JP Morgan to face 4% add-on; Wells Fargo a cut to 1.5%

People moves: Goldman loses three to fintech start-up, departures at Bank of America, and more

Latest job changes across the industry

Too much of a good thing? Banks mull over excess deposits

Surge in non-operating deposits leaves banks with a severe hangover