Federal Reserve

Swaps push-out a 'vast overreaction', says OCC's Walsh

Section 716 of the Dodd-Frank Act is based on a misperception of OTC derivatives, says acting OCC head - who also acknowledged criticism of US uncleared margin proposals

Use of OECD ratings in US market risk proposals questioned

Country risk classifications "are not sovereign ratings" says OECD. US regulators last month proposed using them as an alternative to external credit ratings

Risk managers complain about Fed stress test workload

Twelve new banks are included in this year's US stress test, and some institutions are unhappy about the extra work

CFTC's Sommers and O'Malia attack 'unworkable' Volcker rule

Republicans dismiss prop trading ban as overly complex, unworkable and unenforceable

Basel 2.5: US ratings workaround too punitive, banks complain

Basel 2.5: US ratings workaround too punitive, banks complain

July deadline in question for Volcker implementation

Industry experts divided over Volcker deadline of July 2012

Supervision not regulation, says SEB's Hansen

Rather than rushing to increase regulation and potentially creating compliance costs and regulatory risks, authorities should be getting involved at the ground level to improve supervision, says Lars Hansen, Swedish insurer SEB Life’s chief risk officer

Repeal of Dodd-Frank's swaps push-out seen as unlikely to pass Congress

Despite positive vote by House subcommittee, lawyers say a bill repealing section 716 of Dodd-Frank will not pass

Axa IM fixed-income head says euro collapse more inflationary than ECB printing euros

It is difficult to foresee borrowing costs for Italian, Spanish or other troubled debt falling permanently with "anything other than the ECB being used as a lender of the last resort", says Chris Iggo

Non-US banks stunned by Volcker compliance regime

Non-US banks stunned by Volcker compliance regime

CFTC will publish its own Volcker rule language, says Sommers

Supervisor will publish its own Volcker rule for consultation – although little progress has been made so far, says CFTC commissioner

US watchdog spots conflict of interest with Fed director roles

US Government Accountability Office identifies three examples where senior bank executives might have benefited from their positions on regional Federal Reserve boards

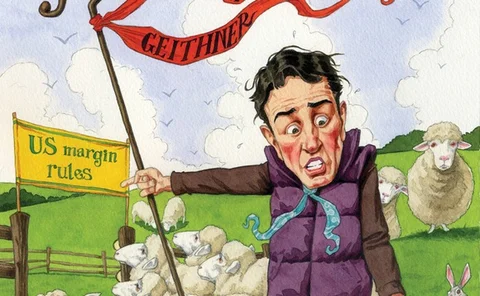

Foreign regulators leave US isolated on uncleared margin rules

Follow the leader?

FSB: risk managers should advise on compensation

FSB remuneration guidelines suggest all firms should have risk management executives on compensation committee

US regulators ask DOE lab to study flash-crash forecasting tool

US regulators enlist Department of Energy computing power to analyse metric that aims to predict catastrophic market events

AMA and loss data collection on the rise at US banks

More US banks expected to employ AMA, while new stress-testing proposals increase interest in operational risk quantification among smaller banks

Prop trading ban set to crimp market-making and hedging activities

Putting a stop to prop

Political pressure will come to bear on US margin rules – Risk.net poll

More than half of respondents expect regulators to back down over extraterritoriality application of margin rules

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

Risk Japan 2011: Mizuho Securities CRO praises Fed's Jackson Hole position; looks to Japan's new prime minister on JGB security

During a question and answer session at Risk Japan 2011 in Tokyo today, Mizuho Securities chief risk officer, Kenji Fujii, tells delegates Fed chairman, Ben Bernanke, was right not to have announced a new wave of quantitative easing last week. He also…

Options traders braced for further SNB intervention

Demand has switched from downside euro/Swiss franc options to upside options in anticipation of further Swiss franc weakening measures from SNB, say senior options traders

US 'shooting itself in foot' with derivatives margin rules - Issa

Congressman Darrell Issa attacks margin rules that threaten to isolate US banks. Foreign regulators say they have no plans to copy the proposals