Credit Suisse

Credit Suisse’s op risk up $6.5bn on subprime-era litigation

Increase offsets the removal of Archegos-related capital add-on by Finma

UBS incurred two VAR breaches in Q2

Risk Quantum understands the VAR backtesting exceptions stemmed from the Archegos blowout

Foreign banks perform better in 2021 Fed stress tests

Intermediate holding companies reported higher post-stress capital and leverage ratios than their US peers did

Fed stress test: JP Morgan would bear brunt of losses

Dealer’s giant loan portfolio hit the hardest among 23 participating banks

Fed stress tests stretch Goldman Sachs, HSBC

US dealers toe binding minimums in latest DFAST exercise

Could global regulators miss another Archegos whale?

Spotting systemic risk from OTC swaps requires cross-border access to derivatives data

Banks invest in futures utility to guard against tech snafus

FCMs, including Goldman and JP, stump up $44 million to fund FIA Tech push to standardise trade processing

US unit of BBVA on the brink of a VAR breach in Q1

Largest loss-to-VAR ratio at the firm was highest among the 12 intermediate holding companies

Finma add-on inflates Credit Suisse’s credit RWAs

The Sfr5.8 billion additional capital buffer accounts for two-fifths of bank’s quarterly increase

How Credit Suisse fell victim to its own success

Roots of Archegos loss can be traced to business strategy the bank embraced back in 2006

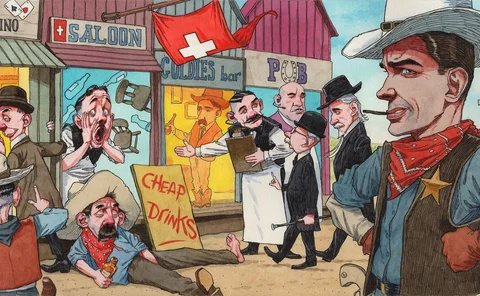

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Goldman’s swaps clearing unit boosts client margin by $1.2bn

The top eight FCMs accounted for 95.8% of total client required margin, down 96.4% YoY

Op risk data: Money laundering gaffes cost ABN €480m in penalties

Also: Turkish crypto exchange’s missing $2bn; online payment scams rise during Covid. Data by ORX News

People moves: senior swaps at HSBC, new CEO for Nomura, and more

Latest job changes across the industry

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

Risk management is not a job for compliance

Credit Suisse losses show why boards require real risk management expertise, says ex-BoE supervisor

Trading VAR at UBS peaked after Archegos blow-up

Swiss bank still posted a fall in market RWAs quarter on quarter

Archegos debacle prompts Credit Suisse to slash prime services

Executives pledged $35 billion of cuts to investment bank leverage exposure

After Archegos, Credit Suisse clients tap rivals for clearing

Swiss bank is said to have lost clearing business amid uncertainty over its future

Would margin rules have checked Archegos? Perhaps not

Regulator-prescribed margin methodology permits six-times leverage on equity swaps

People moves: facing the funds fallout music, CS changes chairs, and more

Latest job changes across the industry

Archegos fiasco clips Credit Suisse’s capital ratio

CET1 ratio will be “at least” 12% for Q1

What good are risk disclosures anyway?

Regulatory filings and shareholder reports offered no heads-up of Archegos’ troubles

SA-CCR more a burden to Credit Suisse than UBS in 2020

At Credit Suisse, SA-CCR RWAs increased 134%