Credit Suisse

Asia moves: Senior hires at Deutsche Bank, Maybank and more

Latest job news from across the industry

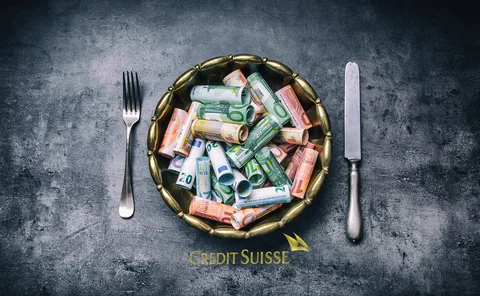

Op risk data: Dodgy tax practices cost Credit Suisse €240m

Also: Binance blockchain hack; ING’s Polish AML fail. Data by ORX News

Credit Suisse shake-up, HSBC’s new CFO, and more

Latest job changes across the industry

Credit Suisse’s new markets strategy builds on the old one

GTS is scrapped, but blueprint of connecting wealth management to markets remains intact

Credit Suisse’s LCR down 20% in October as depositors flee

Sub-group liquidity requirements breached as chatter around bank’s solvency spurred cash outflows

Barclays, Deutsche, Credit Suisse take $437m hit on leveraged loans

Higher interest rates eroded value of facilities stuck in pre-syndication during Q3

Op risk data: Banks slapped for lax WhatsApp oversight

Also: Wintermute suffers crypto hack; CS settles over Archegos and Greensill. Data by ORX News

Client margin at Credit Suisse shrinks to just $25m

Required funds for swaps meet same fate as F&O trades, as exit from prime services continues

Derivatives house of the year, Japan: Credit Suisse

Asia Risk Awards 2022

Credit derivatives house of the year: Credit Suisse

Asia Risk Awards 2022

Structured products house of the year: Credit Suisse

Asia Risk Awards 2022

Op risk data: Rost Bank execs conspired in 107bn ruble ruse

Also: Citi stumbles on market abuse; Jefferies faces latest fine over phone misuse. Data by ORX News

People: Credit Suisse’s new CFO, Velani joins BofA, and more

Latest job changes across the industry

Archegos revives Lehman-era trade booking controversy

Experts debate whether defaulted TRS positions should have become house exposures immediately

Using correlation to model op risk losses may be unsafe – study

Techniques for linking economic factors and bank losses produce varying – and sometimes contradictory – results

FCM client margin for F&O hit all-time high in May

But concentration among top 10 broker-dealers continues to shrink

Op risk data: SEC says no to Charles Schwab robo-adviser

Also: China steps up scrutiny of wealth management products; Libor fines still rumble on. Data by ORX News

Credit Suisse goes off piste in latest DFAST

US unit of Swiss bank underestimated leverage hit in Fed stress test

Foreign banks outperform US peers on DFAST

Intermediate holding companies reported higher post-stress capital and leverage ratios under the Fed’s severely adverse scenario

Systematic hedge funds eye outsourcing to bank algos

Cost pressures encourage new stream of clients to pass FX algo trading to banks

One by one, dealers embrace standardised FX reject codes

Investment Association’s proposed codes finally begin to take hold after Covid setbacks

People: Richardson rises at JPM, Barclays hires Zaimi in Apac

Latest job changes across the industry

Hedge funds pile into renminbi FX options

Investors target call spreads and RKOs in what traders say is one of 2022’s most profitable trades

Standard risk measures low-balled Archegos exposures

When a potential blow-up doesn’t show up, what use are VAR, SA-CCR and stress tests?