Commodity Futures Trading Commission (CFTC)

CFTC still facing tough to-do list

Regulator has finalised 39 rules but 14 remain at proposal stage - including six that have been outstanding for more than 500 days

CFTC may alter stance on physical gas deals

Agency expected to respond to natural gas industry fears about Dodd-Frank swap definition

CFTC offers last-minute Dodd-Frank relief

Agency eases compliance burden for commodity and energy firms

CFTC’s clearing timeline prompts backloading "meltdown"

A re-reading of the CFTC's phase-in rules for central clearing is prompting alarm among buy- and sell-side firms

Section 716: The do-nothing approach

The do-nothing approach

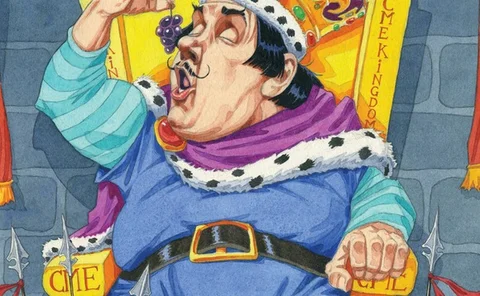

The power behind the throne: CME and the fight for futures market supremacy

It’s the biggest futures exchange in the world, so CME Group naturally has both friends and enemies. Some of its friends are very well connected – and some of its enemies claim this influence has been used to stifle competition, allowing the exchange to…

Position limits rejection lifts compliance burden

Rejection of Commodity Futures Trading Commission rule brings short-term relief and longer-term uncertainty, say consultants

Court ruling may be death of CFTC’s position limits

Experts say appeal is unlikely – and CFTC must prove commodity market speculation before re-proposing limits

Counterparties abandon US public utilities over Dodd-Frank fears

Publicly owned utilities say a growing number of energy companies are refusing to trade with them ahead of the deadline for swap dealer registration

Ice move from swaps to futures unlikely to be last, says O’Malia

The decision by Ice to speed up the transition of its cleared OTC energy contracts to futures reflects regulatory uncertainty, and is likely to be replicated by other exchanges, says CFTC commissioner

Asian energy markets liquid enough to sidestep Dodd-Frank compliant firms

The extraterritorial impact of the US Dodd-Frank could be sidestepped by Asian players opting to conduct swap trades with players outside of the regulation’s orbit

Libor in need of ‘massive makeover’, CFTC’s Chilton says

CFTC's Chilton says a complete overhaul of Libor is needed - including distancing it from the BBA

Trade reporting pressure increases as CFTC deadlines loom

DTCC data repository has received provisional CFTC approval, just three weeks ahead of mandatory reporting for credit and rates, with forex reporting due to begin in January

OTC trade sizes could shrink under Mifid reporting rules

Market-makers will be uncomfortable taking on less liquid trades if instant reporting is required, warns a panel at Isda's European conference

New Isda protocol may not fix business conduct bottleneck

Dealers hope to comply with new business conduct rules by amending thousands of Isda master agreements – but a standardised protocol published last month is expected to leave some clients cold

Knight Capital losses spur focus on algo risk management

A dark Knight for algos

Fingerprint, aggregation fears hit swap dealer countdown

Prints and be damned

Neal Wolkoff: OTC market faces break-up blues

Break-up blues

Sefs hit by Dodd-Frank disclosure rules

New trading platforms must enable dealers to make pre-trade disclosures – but industry doesn't know what information needs to be provided

Reprieve for dealers as CFTC extends business conduct deadline

Ten-week extension comes as welcome surprise to dealers, but industry still has concerns about timing and content of new rules

CFTC cross-border guidance a threat to ‘systemic stability’, say Asian regulators

Leading regulators from across Asia complain of the potentially negative impact of the US regulator’s latest proposals