British Bankers’ Association

HSBC's Green shames 'greedy and short-termist' financial pay

Daily news headlines

Basel implementation chief: no need for Basel III

Modifications being made to Basel II are sufficient to tackle the flaws in the framework and "we are certainly not going in the direction of Basel III", according to the chair of the standards implementation group of the Basel Committee on Banking…

Turner: Capital and liquidity are core of bank regulation

Banking supervision must focus on better capital and liquidity standards, said Adair Turner, chairman of the UK Financial Services Authority (FSA).

EU overhaul of financial supervision raises questions

Ambitious plans laid out by the European Commission to revamp the supervisory framework of the European financial markets have raised concerns about the possible implications of creating new supervisory bodies.

Industry bodies release G20 regulatory reform paper

Daily news headlines

UK’s FSA sets sights on retail banking

Daily news headlines

BBA publishes conclusions on Basel II Pillar III

Daily news headlines

No changes to Libor, says BBA

The British Bankers' Association has ruled out major changes to its Libor fixing, despite criticism earlier this year that the widely used interbank rate had become unreliable.

Compensation culture

Incentive Risk

Bankers' incentives blamed for crisis

In the wake of the credit crisis, senior bankers and regulators are considering changes to incentive programmes, which might have encouraged traders to make short-term bets without considering long-term risks.

BBA favours colleges of supervisors

Daily news headlines

Libor's true colours

Interest rates

Governments must focus on financial crime

Daily news headlines

Strength in numbers

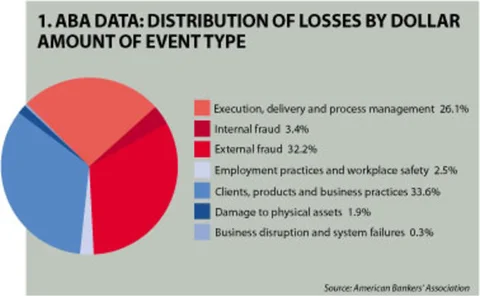

Data consortiums for loss information are popping up all over the globe. Why are they proving so popular? Duncan Wood reports

Batting for British banks

Angela Knight, chairperson of the British Bankers' Association, talks to Nick Kochan about her hard-earned reputation as the scourge of the international regulatory community

A compliance can of worms?

Regulatory News

Credit derivatives to hit $33 trillion by 2008, says BBA

The global market for credit derivatives is expected to reach $33 trillion by the end of 2008, according to a British Bankers’ Association (BBA) report released at its credit derivatives conference last week.

A Cleaner Act for Credit Derivatives

As credit volumes have increased, firms must grapple with price transparency and operational risk.

Home-host hearing raises key issues

LONDON – Although the tone of the October 5 public hearing at the secretariat of the Commission of European Banking Supervisors (CEBS) on guidelines for greater supervisory co-operation between consolidating supervisors and host supervisors (CP-09) was…

UK speeds towards Basel II implementation

LONDON – Momentum is gathering at the UK’s Financial Services Authority (FSA) for the implementation of Basel II in the island nation.

FSA to skip QIS4 to concentrate on QIS5

LONDON – The UK’s Financial Services Authority (FSA) will not be participating in a quantitative impact study four (QIS4), but will instead focus on providing information for a QIS5, according to a letter from the regulator to industry association…

Credit derivatives professionals slam IAS

Financial market participants have slammed International Accounting Standard 39 (IAS 39) for financial hedge instruments, according to a British Bankers' Association (BBA) credit derivatives survey.