Basel Committee on Banking Supervision (BCBS)

CoRep and FinRep: a "Frankenstein's monster" of reporting

Mind the language gap

Basel Committee proposes scrapping VAR

Review recommends switch to expected shortfall, postpones CVA charge overhaul, and retains split between banking and trading books

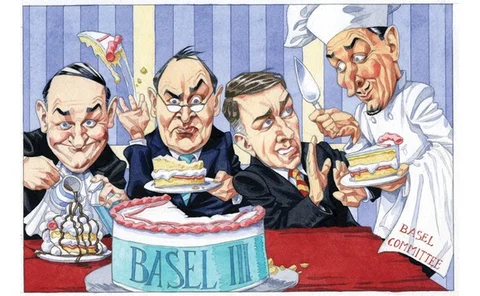

Different preferences create divided implementation of Basel III

A matter of taste

Bail-in regimes will reduce demand for bank debt - Risk.net poll

Over three-quarters of poll respondents believe new resolution plans will hurt market for bank bonds - at a time when issuance needs to increase

BoE's Tucker: FPC capital powers 'won't be popular'

Attendees at ACT conference raise concerns about increased lending costs after Bank of England’s Tucker argues for powers to raise sectoral capital levels

CPSS-Iosco lifts cloud on forex options clearing

CCPs do not have to guarantee settlement, CPSS-Iosco rules - but issue could still have some way to run

New regulations could cause $7 trillion "collateral shock"

Trio of rules - on liquidity, clearing and margin for uncleared trades - will hoover up vast amounts of collateral, market participants fear

Regulatory differences could be behind RWA inconsistency, report suggests

Initial findings of a review led by the European Banking Federation suggests differences in regulatory regimes could be behind a divergence in RWA numbers

US dealers breathe easier as global uncleared margin rules take shape

The extraterritorial scope of US margin rules would have left US banks’ overseas swaps business in tatters, but an international working group looks set to deliver a reprieve by endorsing similar rules

Bank capital

In depth: bank capital introduction

Credible capital: regulators prepare to tackle RWA divergence

Credible capital

A regulatory Catch-22: bail-in plans collide with Basel's NSFR

The funding squeeze

SIG to keep an open mind on RWA probe, says Himino

The Basel Committee’s standards implementation group has begun an investigation into RWA consistency, but chair Ryozo Himino says there might be good reasons for discrepancies

Basel 2.5 caused €200 billion jump in RWAs

European banks saw their RWAs leap at the turn of the year, as new trading book rules collided with the EBA's call to achieve a 9% capital minimum

Basel III commitment in question, says ex-committee member

The ongoing crisis in Europe is casting doubt over Basel III framework, says a former Basel Committee member

Risk Annual Summit: CVA rethink needed, says HSBC risk specialist

Market risk hedges should be recognised when calculating CVA capital charge, says HSBC market risk modelling head

Risk Annual Summit: Loan and bond markets will suffer under Basel III, say panellists

Supervisors should embrace new form of securitisation to encourage bank lending, argues Ernst & Young’s Patricia Jackson

Cutting operational risk capital through insurance

Using insurance can produce significant capital savings - but some legal problems remain

Managing operational risk at commodity trading firms

Managing operational risk

South African banks will struggle with CCP default fund requirements, say participants

Default fund contributions will be too onerous for South African banks, say conference participants

Banks tout break clauses as capital mitigant

Breaking with tradition

Adapting banking supervision for a crisis scenario

Rethinking banking supervision

Beyond Basel 2.5: regulators prepare trading book review

Beyond Basel 2.5