Basel Committee on Banking Supervision (BCBS)

JP Morgan and the CRM: How Basel 2.5 beached the London Whale

It’s the untold story of JP Morgan’s credit trading losses – how traders were able to reduce risk-weighted assets while loading up on risk, and the part played by Basel 2.5. Michael Watt reports

G-Sibs facing ‘a tall order’ in meeting 2016 data deadline, UK regulator warns

The FSA’s Gerald Sampson says large, complex banks may struggle to meet a 2016 deadline for risk data aggregation and reporting standards

ALM Europe: Basel right to rein in capital models, says EIB exec

Regulators should be more intuitive in their approach to capital levels, EIB treasury risk head tells conference

Pfeifer changes role at Commerzbank

Former head of op risk switches to project management role

Proposed intraday liquidity reports ‘not feasible’, banks say

Basel Committee's proposed new reports on daily liquidity needs would involve "thousands upon thousands" of data points, according to critics

Isda defends trading book models in response to Basel proposals

Isda pushes alternatives to Basel Committee review of trading book capital rules in leaked comment letter

Hong Kong banks need to focus on local fund-raising strategies to meet Basel III requirements

Meeting Basel III liquidity requirements will mean banks in the Special Administrative Region will need to look locally, according to KPMG

Industry split over Basel trading book review

Comment period ends on September 7, but banks are struggling to find common ground

Industry slams 'unworkable' Esma proposals on indirect clearing

Clearing members would be forced to guarantee trades executed by their clients' clients - on terms the member firms have not agreed

Basel settlement risk guidance puts new demands on forex market

Governance, replacement cost risk, liquidity risk, operational risk and legal risk are among the issues forex dealers must address, according to newly released Basel Committee guidance

End-users will stop using derivatives – Risk.net poll

Proposals to require derivatives users to post initial margin on uncleared trades will cause many end-users to stop using derivatives, say a majority of survey respondents

Model foundations of Basel III standardised CVA charge

The credit valuation adjustment (CVA) capital charge in Basel III comes in two flavours: advanced (simulations) and standardised (formula). In this article, Michael Pykhtin shows that the standardised CVA charge formula can be obtained by adding several…

Dealers seek clearing exemption for new TriOptima service

TriOptima’s new risk mitigation system, triBalance, is a big hit among dealers – but it faces a regulatory death sentence

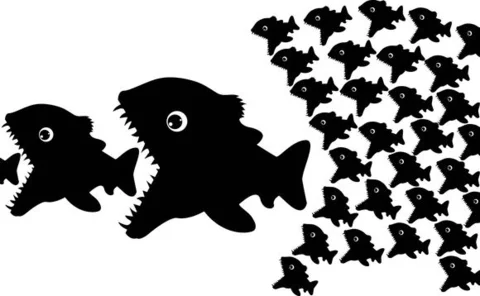

Risk 25: Banks prepare for a low-RWA future

Weight loss: preparing for a low-RWA future

Risk 25: The search for margin efficiency

Margin efficiency: The new battleground

Risk 25 firms of the future: Basel Committee

Implementing rules and filling in gaps

Risk 25: Cutting edge classics

Don’t say we didn’t warn you

Relief for dealers as Basel reins in capital for cleared trades

Basel Committee addresses long-standing complaints over default fund exposures and client clearing

Lack of uptake hinders AMA development in UK

Abandoning the AMA?

OpRisk Asia review: Exploring Asia’s AMA anomalies

Asia’s AMA anomalies

Don't blame the quants, says Merton

Quantitative models were unfairly criticised in the aftermath of the financial crisis, says legendary quant and co-creator of the Black-Scholes equation, but there’s plenty for quants to work on in the current environment