Opinion

Investment fund leverage: the known unknowns

More work needed on first-mover redemption incentives and margin calls, says Iosco chief

Libor battles aren’t over, but the war is won

Transition will shift into new phase next year, leaving systemic threats behind

Op risk data: Mashreq fined $100m for Sudan sanctions busting

Also: Westpac client scams go west; Navient and AFTS schooled over student loan misrule. Data by ORX News

China regulation: the path clears slowly

Co-ordination among Chinese regulators has improved, but new data law shows continued tensions

Systemic banks: black boxes on green issues

Less talk and more action needed around climate disclosures linked to carbon emissions

Follow the moneyness

Barclays quants extend Bergomi’s skew stickiness ratio to all strikes

EU’s Basel III delay invites all to play for time

The message not to dilute reforms got lost on the way from Frankfurt to Brussels

Op risk data: Deep woe as deep voice clone cons UAE bank

Also: ING mirrors ABN client loan loss; CS lands huge fine for tuna bonds. Data by ORX News

Blame to spare in UK energy supplier debacle

Price cap was part of the problem, but lack of hedging and oversight also contributed

Estimating loan loss provisions may have just got easier

Commerzbank quant proposes shortcut to calculate lifetime loan loss reserves

After FTSE inclusion, China bonds still face CNY hedge hurdles

Lack of pricing competition and costly hedges top buy-side hurdles to investing in China, says ChinaFICC CEO

Stable mates: the interoperability of cryptocurrencies

Why central bank reserves could be a better option for backing stablecoins than Treasuries

Bond hedging: China must be bolder

Opening access to bond futures market for foreigners could give big boost to China govvies market

Op risk data: Crypto exchange BitConnect hit with $2bn lawsuit

Also: Legacy €1bn tax liability levied on WestLB ‘bad bank’; ABN and Wells Fargo compensate clients. Data by ORX News

An ‘optimal’ way to calculate future P&L distributions?

Quants use neural networks to upgrade classic options pricing model

Citi reorg the final note in failed swaps clearing model

Strategic shift from OTC clearing powerhouse to client support function marks the end of an era

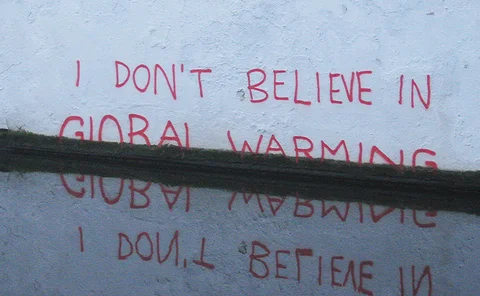

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

Overhyped green status is no longer a risk-free sales tool

Asset managers’ ESG claims will now be more closely scrutinised following DWS allegations

OTC derivatives clearing: no turning back

Clearing advocates have plenty of reasons to feel optimistic about the future

Algo sniffers make a tough business tougher

FX spot is already a hard game for many LPs and the rise of skew sniping only makes things harder

Op risk data: DeFi-ant crypto hacker steals $610m

Also: Amundi fined for index manipulation; Wells pays out over client fraud. Data by ORX News

Machines can read, but do they understand?

A novel NLP application built on a Google transformer model can help predict ratings transitions

A defence against the next convexity crunch

Crédit Agricole rates traders describe a new way of hedging the risk of bond convexity

A new metric for liquidity add-ons: easy as ADV, but better

Proposed measure allows brokers to calculate stable, stock-specific liquidity add-ons