News

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

Full amount trading picks up as dealers improve pricing

As much as 70% of volumes at some FX venues are now traded as full amounts rather than in slices

EU banks lose relief on model test after FRTB delay

Deferment of new trading book regime to January 2026 eats into transition period for “erratic” P&L attribution test

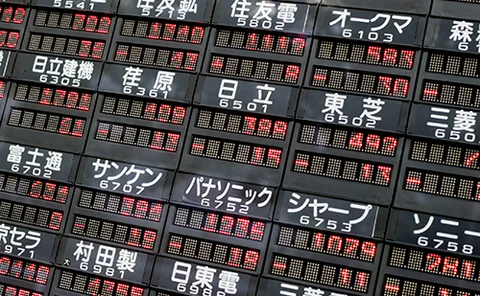

Futures exchanges seek clarity on China licensing regime

Hazy details on landmark Futures and Derivatives Law breeds legal uncertainty, unnerving operators

Some EU banks wanted option to start FRTB on time

Representatives of member states raised possibility with European Commission at July meeting discussing the delay

Iosco delays pre-hedging consultation to November

Review into controversial practice splits industry

Marex plots interest rate clearing push

UK broker is live on LCH and plans to be a “day one” clearing member on FMX

People: SocGen’s Farah replaces Salorio, Deutsche makes credit hire, and more

Latest job changes across the industry

Investors choose safer bank bonds as AT1 opportunity wanes

Technical factors mean senior bank bonds now offer relative value

Dealers bruised by surprise renminbi vol surge

Rush to re-hedge USD/CNH exotics left banks in grip of painful short gamma squeeze

Eurex default fund reshuffle leaves members frustrated

Clearing members say concentration margin add-ons would be fairer than buffer on all portfolios

HSBC loses FX forwards market share with EU funds

Counterparty Radar: UK bank reported 6% drop in notional volumes with Ucits funds in H2 last year

After the selloff, competing theories on dealer gamma

Tier1 Alpha sees $74 billion short gamma catalyst; SG says rapid return to positive territory had calming effect

Bitcoin ETFs drive demand for borrowing in crypto markets

Mismatch between cash and crypto settlement cycles creates pre-funding challenge

New fee plans for FXGO rile dealers

Bloomberg plans to charge spot FX market-makers from next year

CME, FICC in talks to expand cross-margining to client accounts

New rules and account structures will be needed to allow cross-margining by non-members

Margin calls jumped threefold as global markets sold off

FCMs claim no client defaults, but episode revives complaints of procyclical margining

Treasury futures super-user switches to swaps

Capital Group’s Anbax fund slashes UST futures holdings in move to alternative rates derivatives

Traders flipped long yen vol ahead of market rout

Hedge funds and real money bought long yen volatility in the run-up to Monday’s turmoil

Vega peak was foothill in historic Nikkei selloff

JFSA scrutiny has curbed issuance of autocallables, so stock plunge generated light re-hedging

No end of peer-to-peer demand for securities financing

After Archegos, buy side turns to fellow asset managers for diversity and liquidity in securities financing and repo

CrowdStrike outage spurs rethink on ‘critical’ vendors

Some want US regulators to designate tech firms that pose risks to financial stability

Coex Partners hires former Citi head of FX Apac sales

Matt Long joins Coex in Singapore to oversee FX execution and trading strategy for regional clients

FX venues improve ‘stickiness’, Citi review finds

Improvements in tech stability, execution quality and bespoke services appease users