Exchanges

A complicated option

Germany

A solid foundation

Germany

Shopping for curves

Germany

Hanging on at the top

Germany

Powernext selects Trayport for emissions trading, awaits CO 2 allocation

French electricity exchange Powernext will use software supplier Trayport’s Global Vision platform for CO 2 emissions trading, but is still waiting to start the spot emissions market it first announced in January.

The swap terminator

Germany

The FSA’s quest for respect

Hector Sants, head of wholesale markets at the Financial Services Authority, talks to Nicholas Dunbar about his plans for increased regulatory focus on fixed-income structured products and hedge funds

CSFB launches Taiwan broking business

Credit Suisse First Boston (CSFB) has launched its derivatives broking business in Taiwan. The bank will trade futures and options listed on the Taiwan Futures Exchange (Taifex) for qualified foreign and domestic clients.

Credit managers hope for new accounting blueprint

Mark-to-market accounting has frustrated credit portfolio managers at the largest international banks. It’s made their loan books more volatile and their derivatives hedges less efficient. But accounting standards setters may be ready to review the rules…

Checking up on the ‘Belgian dentist’

Country profile: Belgium

Inside the FSA

Q&A

HVB quotes CDS prices on Dax 30 names

CDS market

Merged offerings

Special report: France

In defence of Coso

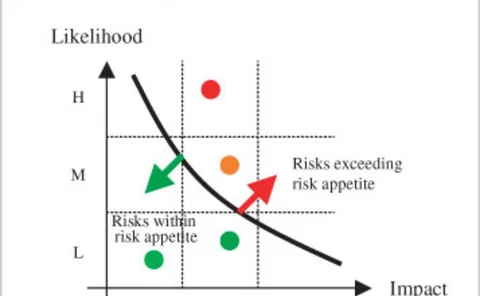

METHODOLOGY COSO REVISITED

The top stories from RiskNews

Feature

What will Chicago do with the money?

New angles

What banks can learn from Solvency II

Capital adequacy

Derivatives dealers focus on mid-caps

Derivatives dealers are focusing more on mid-cap corporates this year as an alternative to the arguably over-banked blue chip companies, say some market participants.

In a muddle over MiFID

The EU’s Markets in Financial Instruments Directive (MiFID) has appeared like a bolt from the blue for most op risk managers. Should they be scared? By Duncan Wood

Greenpeace protest at IPE fuels debate on emissions trading

Greenpeace’s invasion of London’s International Petroleum Exchange (IPE) on Wednesday was intended to draw attention to the environmental impact of ‘big oil’ on the day the Kyoto Protocol came into force. However, by attacking an exchange that is about…

UK broker trade group to launch emissions indexes

The London Energy Brokers’ Association (Leba) will launch a series of ‘green indices’, which it says are designed as independent benchmarks for the European emissions market. The association will release both spot and forward indexes, with the aim of…

DrKW becomes first foreign member of Warsaw Stock Exchange

Dresdner Kleinwort Wasserstein (DrKW) today became the first non-Polish financial institution to become a member of the Warsaw Stock Exchange. This will allow DrKW’s institutional clients to trade Polish stocks and derivatives from April 1.