Exchanges

SMX purchase gives Ice two-year Asia advantage over rivals

Atlanta-based derivatives exchange Ice's decision to scoop up SMX gives the firm on-the-ground presence for clearing and trading in Asia

Philippine Stock Exchange partners with SGX for equity futures – Hans Sicat profile

PSE chief Hans Sicat views cross-border partnerships as vital for development of Asean exchanges, although domestic regulation creates some obstacles

ASX looks to volatility-linked products to drive Australia Vix futures liquidity

Increasing the potential liquidity pool a major aim for Australia volatility futures market

Eurex preps launch of FX options and futures

German derivatives exchange will move into the forex market in October as it aims to compete for volume in listed futures and options

OTC clearing presents HFT opportunity in Asia

Over-the-counter clearing to present greater access and profitability to high-frequency trading firms as electronic trading of OTC products gets under way in Asia

Regulation, tax and technicalities recast European turnover, as French volumes plummet and Italian activity recovers

Tax, legal and practical reforms to the way structured products are transacted in France have slimmed the market to a slither, while similar changes have proved a spur to the Italian structured products revival

Asia exchanges set for overhaul as competitiveness wanes

Solid structures

Singapore positions itself as OTC clearing hub for Asia

Clearing link with KRX will lead to larger volumes and efficiencies at SGX

Exchange consolidation in Asia making trading technology vulnerable to failure

Competition among exchanges in Japan is necessary to prevent systems outages such as those in the Osaka Securities Exchange earlier this month

Risk Johannesburg: JSE ‘monopoly’ hurts liquidity, says Investec exec

Regulators should open up listed derivatives market by encouraging dealer liquidity pools, algo trading expert tells conference

trueEX: e-trading pioneer offering one-stop swap shop

In 1999, Sunil Hirani launched an electronic trading platform for credit derivatives, which sold for $625 million nine years later. Now he's back - and his new idea is an exchange for interest rate swaps. Peter Madigan reports

Let swap platforms trade futures – Icap’s Spencer

Icap's chief executive says proposed derivatives rules are reinforcing exchange monopolies

Brokers lift the lid on swaps-to-futures confusion at Ice

When swaps become futures

Ice-NYSE Euronext: Good or bad for margin offsets?

Merger margins

Credit Suisse sells ETF business to Blackrock as synthetic model falters

Synthetic meltdown

Futurisation forces hundreds of traders to sit exams

Swaps-to-futures switch at Ice – plus hedge fund regulatory changes – behind threefold jump in numbers taking futures trading exam

MexDer: The Mexican swaps wave

The Mexican swaps wave

RIP OTC: Swap futures gaining buy-side fans

RIP OTC: Swap futures gaining buy-side fans

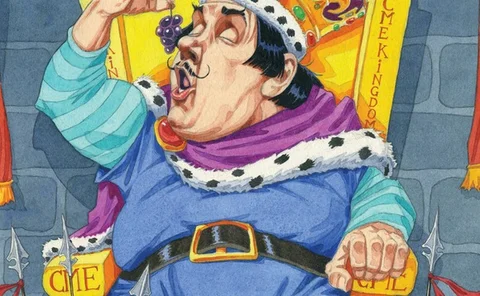

The power behind the throne: CME and the fight for futures market supremacy

It’s the biggest futures exchange in the world, so CME Group naturally has both friends and enemies. Some of its friends are very well connected – and some of its enemies claim this influence has been used to stifle competition, allowing the exchange to…

CME’s new swap future uses Goldman Sachs patent

Licensing agreement could be worth up to 20% of revenues from patented contract, and is seen as an attempt by Goldman Sachs to hedge its bets as new rules threaten OTC market profits

Neal Wolkoff: OTC market faces break-up blues

Break-up blues