Views

How replication simplifies pricing of vol exotics

Barclays quants replicate knock-out corridor swaps using barrier options in bid to make pricing easier

All the news that’s fit to print

While the benefits of the information revolution are clear, the risks it brings should not be underestimated, says Andrew Lo

Podcast: Montoro on FRTB thresholds and non-modellable risks

Senior risk manager also argues Kolmogorov-Smirnov test is better than Chi-squared

Is AD the answer to quicker MVA calculation?

Quants propose faster technique for Simm-MVA based on algorithmic differentiation

Podcast: Antonov on MVA, algorithmic differentiation and model validation

StanChart quant proposes new technique to compute MVA quicker

Financial risks don’t go on holiday

Better mapping of financial system would help avoid seasonal surprises, argues Andrew Lo

Podcast: SocGen quants on exotics calibration, machine learning and autocallable pricing

Deep learning techniques are being explored by the quants to speed up exotics pricing

How old calibration techniques can be applied to exotics pricing

SocGen quants propose technique to more accurately calibrate exotic options

Podcast: Lo on adaptive regulation, machine learning, bitcoin

MIT quant says next project will be to combine behavioural science with tech such as machine learning

Swaptions vol modelling tweak opens up pricing possibilities

Nomura quant proposes local volatility model that can directly calibrate to swaption smiles

If regulations don’t bend, they’ll break

Financial regulation should be adaptive, not reactive, argues Andrew Lo

Podcast: Richard Martin on EM debt, copulas, machine learning

Quant sceptical of machine learning algos and black boxes

How machine learning could aid interest rate modelling

Standard Chartered quant proposes machine-learning technique to better capture rate dynamics

Model risk in the transition to risk-free rates

Transition is an opportunity to reduce multi-rate complexities, say Bakkar and Brigo

Podcast: Quantum computing to boom in next three to five years

Quant speaks of collaboration with Nasa and machine-learning algos for yield curves

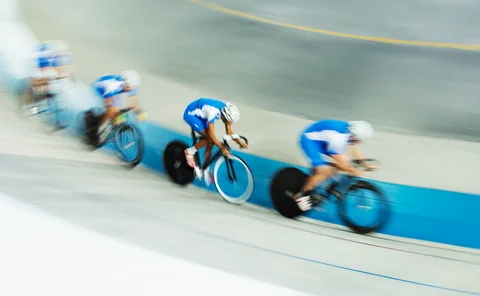

Putting swaptions pricing in the fast lane

Derivatives consultant proposes a model for arbitrage-free pricing

Simple models won’t cut it for systemic risk

Understanding interconnectedness and capturing it within models is a key challenge, say quants

Podcast: Roos on swaptions arbitrage and benchmark reform

Benchmark reform means additional work for rates quants

Podcast: Fries on Monte Carlo, Greeks and the future of AAD

Research on AAD is not complete until it becomes easier to implement, says quant

How not to control trading behaviour

Quants show popular risk measures fail to limit risk-seeking behaviour among traders

Curbing rogue behaviour

Regulators should try to combat rogue trading by measuring traders’ risk-taking differently, say quants

XVA: back to CVA?

Fundamental questions on CVA remain unanswered, writes mathematical finance head

Multicurve modelling is about to get more complex

Research into rates pricing is becoming more urgent given recent regulatory changes

Podcast: Mercurio on Libor, fraud and writing models on a plane

Post-Libor environment and financial crime detection to drive future research, says top quant