Central banks

China's great leap forward

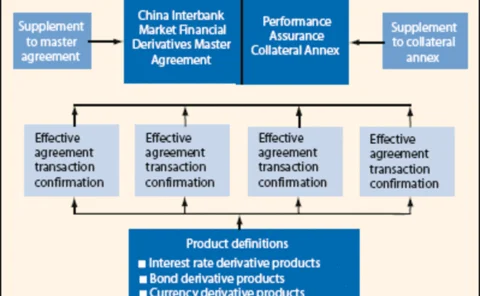

Documentation

Taking cover from falling stocks

Pre-IPO trading

Talking liquidity

Conference report

A long way to go

Longevity

Caution at Cairn

Cairn Capital's chief executive, Paul Campbell, talks to Alexander Campbell

Basel II backlash

Credit Risk

Singed by contingents

Deal-contingent Swaps

Rates rebound

Interest rates

ECB re-enters money markets as fears of volatility return

The European Central Bank (ECB) will push extra liquidity into the money market to counter "re-emerging risk of volatility", it announced on Friday.

Trichet predicts tighter regulations on banks

The president of the European Central Bank, Jean-Claude Trichet, has blamed the summer's crisis on opaque financing models and mistakes by rating agencies, and has called for an overhaul of financial regulation.

BIS announces 135% notional OTC derivatives growth since 2004

According to the Bank for International Settlements' (BIS) latest reports, notional amounts outstanding for over-the-counter (OTC) derivatives increased by 135% to $516 trillion from June 2004 to June 2007.

Regulation and compliance biggest strategic risk, says Ernst & Young

Daily news headlines

Risk USA: Rate cuts do not “bail out Wall St”

The Federal Reserve's recent policy decisions have been “designed to help Main Street and not to bail out Wall Street”, a senior Fed official has declared.

Tax rules - trying to bridge the gulf

MIDDLE EAST

Eyes on the storm

Supranationals

Counting the costs

The cost of much needed oil exploration and production projects has spiralled recently. Roderick Bruce looks at what is driving the cost rises and what their effect may be

Changing the rules

Regulation

Russia reels from liquidity crisis

Central bank lowers minimum reserve requirements in a bid to buoy up vulnerable banks

Banking on a fall

Rates