Matt Cameron

Follow Matt

Articles by Matt Cameron

Sovereign debt crisis undermines LCR, critics say

Bankers at Eurofi conference in Wroclaw, Poland call for a wider range of assets to be eligible for Basel III's liquidity coverage ratio

CRD IV proposals do not deviate markedly from Basel III, says EC's Faull

Jonathan Faull dismisses suggestions CRD IV will lead to uneven application of Basel III

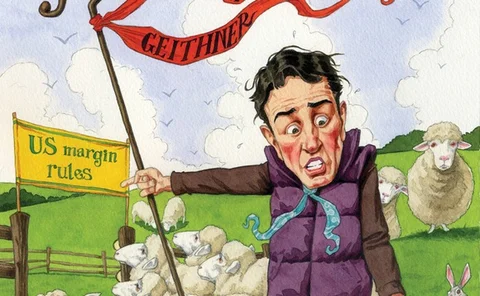

Political pressure will come to bear on US margin rules – Risk.net poll

More than half of respondents expect regulators to back down over extraterritoriality application of margin rules

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

US 'shooting itself in foot' with derivatives margin rules - Issa

Congressman Darrell Issa attacks margin rules that threaten to isolate US banks. Foreign regulators say they have no plans to copy the proposals

Short-selling bans spark confusion over index trades and extraterritoriality

Dealers say volumes have been light as market participants try to work out scope of bans – with confusion arising on index trades and the geographic reach of the rules

US tax fix smoothes way for back-loading buy-side portfolios

US tax fix to aid buy-side portfolio back-loading

EBA stress test results shed light on sovereign derivatives exposures

European bank sovereign derivatives exposures revealed

EC's CRD IV says dealers can ignore portability risks

While Basel Committee deliberates, EC proposes 'value of zero' for contingent risks associated with clearing portability

Fannie Mae says FHFA's margin rules would drive up hedging costs

US mortgage giant says segregating variation margin will hurt FHFA- and FCA-regulated entities, and create new funding obligations for swap dealers

Forex options clearing complicated by guaranteed settlement requirements

CPSS-Iosco guaranteed settlement requirements make foreign exchange options clearing more difficult, say participants

ECB and World Bank call for exemptions from US derivatives rules

World Bank believes imposition of national regulations on multilateral development institutions is unprecedented intrusion on the internal operations of international organisations

Grensted parts company with LCH.Clearnet

The clearer's head of business development - and one of SwapClear's architects - left the firm today

Dodd-Frank extraterritoriality will hurt US banks – Risk.net poll

More than two-thirds of respondents think the long arm of Dodd-Frank will put US banks at a competitive disadvantage

JPM’s Zubrow: US margin rules 'will kill our overseas swaps activities'

US banks will be shut out of the market for uncleared derivatives, says JP Morgan's chief risk officer

Deutsche Bank merges OTC and listed clearing businesses

Deutsche restructures clearing initiatives in response to global regulatory push towards OTC derivatives central clearing

Geithner letter to Hungarian minister weighs in on Emir open access debate

Market participants believe US letter endorses a narrowing of Emir scope, but a Treasury official says the letter draws attention to gap in regulation

Basel III liquid asset definitions loosened in CRD IV draft

Draft legislation seen by Risk contains less prescriptive language on what counts as an eligible liquid asset under the liquidity coverage ratio

Central bank liquidity would help CCPs in distressed situations, says BIS

BIS weighs in on CCP central bank liquidity access debate

US margin proposals could lock down $2 trillion in assets

Requirement for banks to post initial margin when trading with each other will result in huge amounts of liquid assets being locked down, according to analysis by one US prudential regulator