Lukas Becker

Desk editor

Lukas Becker is the markets editor for Risk.net in London, and oversees editorial coverage for FX Markets. His topics of interest include over-the-counter derivatives pricing, structuring, collateral management, market infrastructure across asset classes.

He joined in 2012 as Europe, Middle East and Africa editor of Risk magazine.

He can be contacted on +44 207 316 9129, or on email at lukas.becker@infopro-digital.com

Follow Lukas

Articles by Lukas Becker

Legislative fix sought for Libor fallbacks

Federal law makes it “almost impossible” to change benchmark rates for FRNs

FCA: ‘We can be Libor fallback trigger’

Amid fears of hedging mayhem, Schooling Latter says FCA verdict could be trigger for smoother rates switch

Eurex’s new Swiss rate futures in naming pickle

German exchange used ‘wrong month’ to name Saron futures

HSBC and the risk-advisory robot

Bank has amassed 10-petabyte pool of client data to spot hedging, financing and payments needs

Natixis’s €260m hit blamed on big books and Kospi3 product

Rivals say French dealer grew business too quickly – with leveraged version of Korean index one source of pain

Libor fallbacks set to split cash and swaps

Basis could appear when benchmark dies, with swaps, bonds and loans embracing different fallbacks

Greece slashes rates exposure with €35 billion swap programme

Sovereign debt agency entices 18 banks into hedging programme, locking in historic low rates on bailout loans

EU lawmakers open to delaying ban on critical benchmarks

MEPs propose two-year reprieve for Eonia and Euribor if contractual continuity is at risk

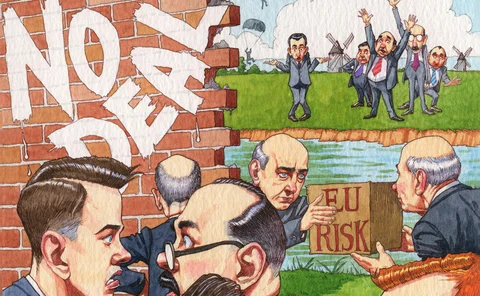

Let regulators manage no-deal risks

EU can stop swaps market falling over a Brexit cliff – and EU firms will be biggest losers if they don’t act

Day one of a no-deal Brexit: swaps and chaperones

Banks, trading platforms, repositories tee up EU entities – and dread the repapering crunch that would follow

Banks to ask EC for delay of benchmarks rule

New ECB rate may appear only months before rules bar use of Eonia and Euribor

Time running out for EU Brexit temporary permissions regime

UK clearing houses may need to eject EU member positions if BoE scheme is not reciprocated by year-end

Buy side using two-way prices in bid to hide trade intent

Number of trades done via ‘request-for-market’ protocol leaps 510% in past year

Esma: Eonia can be used in CSAs after 2020

Swaps users can avoid repapering before BMR deadline but may face basis risks

Offshore Eonia? A weird idea for weird times

As pressure builds in the search for a new rate, some non-EU banks are looking at ways of keeping the existing one alive

First SOFR swaps trade as banks test new benchmark

First OTC trades include two basis swaps and an OIS trade, with JP Morgan thought to be a counterparty

Eonia woes hold up euro swaptions switch

Eleventh-hour derailment for project that has been in the works for a year

Gottex chief on expansion plans amid industry disruption

With brokers facing headwinds, Swiss firm doubles down on Scandi niche

Eonia death will hit valuations and OIS market – expert

Working group hears end of Euribor by 2020 would threaten financial stability

Libor expert: don’t rely on forward RFR rates for transition

Swaps users should embrace backward-looking risk-free rates instead, says chair of UK working group

Buy side using compression tools to create, not destroy

Custom-trading services are booming at Bloomberg and Tradeweb, but not for the reasons intended

Swaps users to get three choices for synthetic Libor

Consultation due next month as industry tries to avoid big losses on benchmark’s death

Number of banks per RFQ jumps in EU, posing risk to prices

Some requests for quote are sent to over 20 dealers, raising worries about information leakage