Duncan Wood

Global editorial director, Risk.net

Duncan Wood is the London-based global editorial director, promoted to this role at the start of 2019. Prior to this, Duncan was editor-in-chief of Risk.net from 2015, with a remit to lead the editorial reorganisation of the website and its print titles. Duncan had been editor of Risk magazine since July 2011. He rejoined Risk as European editor in October 2009, having originally worked for Risk and Asia Risk in London and Hong Kong as a writer and researcher between 1998 and 2000.

In the intervening years, Duncan was news editor for the Oliver Wyman-founded online start-up ERisk.com. He also worked freelance for six years while living in Germany, with his work appearing in Euromoney, Financial News, IFR, and The Wall Street Journal, as well as Risk magazine and its sister titles.

Duncan has written about derivatives and risk throughout his 17-year career in journalism. He is a Neal Awards finalist, and has also won Incisive Media’s journalist and editor of the year awards.

Follow Duncan

Articles by Duncan Wood

O'Malia: US margin splits ‘very difficult’ for OTC market

Isda CEO criticises clashing rules on bilateral margin

Competition is saving end-users from euro swaps price hikes

Swap dealers are often described as a cartel; right now, they are not acting like one

In-depth introduction: Japan

Senior officials at the BoJ and JFSA speak to Risk.net about QE, Basel III and more

CCP basis and the future of cleared swap pricing

Dealers predict "more granular" pricing for cleared trades, after CME-LCH basis blow-out

Courting the AIIB: dealers eye development bank “goodies”

Beijing-based supranational expected to be heavy swaps user

Canada to collateralise cross-currency swaps

Finance ministry hopes two-way CSAs will cut costs and risks on hefty swaps flows

GFMA, IIF, Isda plan liquidity lobbying push

Draft report urges regulators to consider impact of FRTB and FTT on markets

Bail-in: why derivatives are in scope, but out of bounds

Analysing early termination costs - and the risks of contagion - will be tough

Standardised approaches: the risks of reform

Comparing modelled and standardised capital may raise more questions than it answers

In-depth introduction: Mifid II

New rules have the power to transform markets - and baffle participants

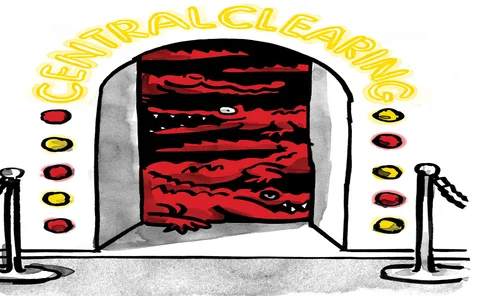

Who will be the dummy in CCP crash-tests?

Clearing houses, banks and regulators could all be caught in the wreckage

Profile: UBS on the past and future of fixed income

Swiss bank's fixed-income trading floor is home to two distinct businesses

Bank swap books suffer as CME-LCH basis explodes

Per-bank losses estimated at $20m; CME could lose business

Cher of the blame: whose fault was the swaps push-out?

Question is not why provision died, but how it was ever born

Banks struggle to make strategy calls as rules pile up

Isda AGM: Interaction between some rules “very, very convex”, says Deutsche exec

Basel lacks data to judge FRTB impact, critics claim

Isda AGM: Proposed trading book rules are “nuts”, says Ramambason of BNP Paribas

CFTC may need to 'step in' to end MAT drought - Reinhart

Isda AGM: no new products added to Sef mandate list in 13 months

Scott O'Malia: time for a regulatory time out

Isda chief calls for a pause in rule-making to "fix the errors"

Ice considers moving Brent contract to avoid EU margin hike

Ice says move is “not an outcome we want to see” but Emir margin could drive users away

Putting FVA in a cage

If banks can't standardise funding charges, accountants or regulators should step in

In-depth introduction: Clearing incentives

Price hikes at Goldman Sachs show how much pressure FCMs are under

Profile: Citadel's Hamill on the fight for swaps market share

New entrant is making prices - and hedging - electronically

Citadel shaking up swaps competition

Chicago firm is now a top-four market-maker on US swap platforms