Insurance

Options for collateral options

When collateral can be posted in multiple currencies, pricing even the simplest derivatives involves optionality, which is often tackled numerically. But by conditioning on a risk factor to make variables independent, this can be simplified. Alexandre…

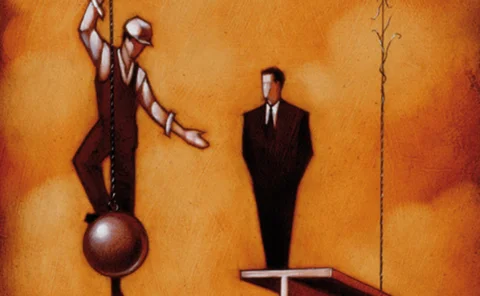

At the mercy of politicians

UK Budget highlights insurers' vulnerability to political risk

US regulators grapple with proposed XXX captives fix

States concerned over use of ‘deregulatory' valuation approach

Bulk purchase of enhanced annuities offers growth potential

Medically underwritten buy-ins offer opportunities but with unique risks

Progressive insurers revise approach to sovereign risk

Some supervisors pressing firms to risk weight sovereign bonds

Concerns mount over periodical payment orders

General insurers embrace capital modelling and revised ALM strategies

Insurers warm to risk factor diversification

Insurers are rethinking their investment process in terms of risk factors

Insurers to repackage assets for matching adjustment

Firms consider structured options for assets to meet Solvency II criteria

Insurance risk managers draw on unstructured data

Latest analytical tools helping insurers to sift through their data

Own funds rule will reduce reported solvency ratios, say insurers

Industry says European Commission proposal will have negative side effects

New York defies NAIC on principle-based reserving

Superintendant Lawsky introduces new formula-based methodology

Insurers face tight deadline for matching adjustment

Firms urged to rush restructuring of portfolios for Solvency II long-term guarantee measure

Japan insurers look to hedge out legacy VA positions

Rise in equity markets makes it less costly for insurers to de-risk

International capital standards expected to merge, say insurers

Insurers question whether one standard will eventually replace another

Variable annuity sales recover in Japan as insurers revise hedging strategies

Simplified product design and buoyant equity markets combine to revive Japan VA market

Solvency II proposals cause confusion on non-euro extrapolation

Draft delegated acts suggest the last liquid point for non-euro currencies could shift

Cuts to securitisation capital charges too small, say experts

But European Commission proposals can stop insurers becoming forced sellers of low-risk securitisations

Insurers urged to review data licence requirements

Negotiate with vendors now to secure best prices, say experts

UK annuity reforms may squeeze insurers' appetite for illiquid assets

Allocations to infrastructure and property expected to reduce following Budget