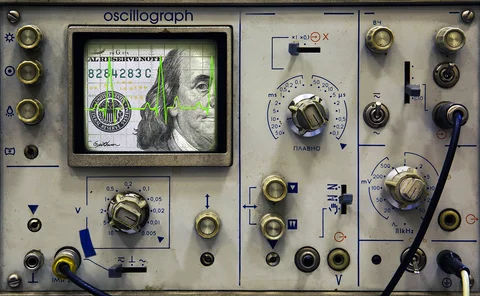

Volatility

Energy Risk Commodity Rankings 2023 winner’s video: Axpo

Following the firm’s strong performance in the 2023 Energy Risk Commodity Rankings, Axpo Solutions' Domenico Franceschino discusses the extreme market conditions of 2022, along with future expectations for the gas and power markets

Counting down to dollar Libor transition

In a Risk.net webinar, experts discussed the impact of market volatility on Libor transition, the availability of term SOFR, developments in non-linear markets and management of forthcoming CCP conversions

How MerQube sold Wall Street on open indexing relationships

Four-year-old Silicon Valley firm sees growing role for third parties as indexes become more complex

How banks can avoid bad haircuts on hedge fund trades

HSBC quant makes case for looking at collateral and funding rates in concert

Initial margin requirements for IR swaps hit record $325bn

CME, Eurex and LCH report aggregate 10% rise in month marred by most severe crisis since 2008

ION Commodities: addressing the market’s recent pain points

Energy Risk Software Rankings winner’s interview: ION Commodities

Zero-day options and the shadow of the apocalypse

For some, 0DTEs could spell doom in adverse market conditions; others dismiss such talk as dramatics

Initial margin at OCC declined over Q4

Calmer markets triggered downward revision as requirements drop $30bn

The relationship between crude oil futures and exchange rates in the context of the Covid-19 shock: a tale of two markets

The authors investigate the high-frequency intraday return and volatility transmission between crude oil futures prices and exchange rates during the 2020 Covid-19 pandemic in the Brent and INE markets.

‘Spectacular’ vol disconnect ‘ominous’ for risk assets

Historic divergence has caught the eye of Boaz Weinstein and others

US banks’ VAR breaches up 2.5x in 2022

‘Hypothetical’ one-day losses exceeded VAR on 55 occasions, as losing trading days prevail

The haves and the ‘have bots’: can AI give vol forecasters an edge?

Firms look to machine learning and natural language processing to gain advantage over peers

CCP ‘skin in the game’ still dwarfed by member contributions

Even as markets churned in 2022, clearing houses coughed up only 2% of funds at end-September – the same as the previous year

Momentum transformer: an interpretable deep learning trading model

An attention-based deep learning model for trading is presented

‘Hung’ leveraged loans push Barclays’ VAR to 10-year high

Trading risk gauge hit a peak of £73 million in Q4, £2 million shy of 2012 peak

Risk.net’s top 10 investment risks for 2023

Geopolitical frictions, sticky inflation and a hard landing are among the hazards cited by investors

Options liquidation can be costly. How costly?

New model uses open interest and volume data to calculate the expense of selling an options portfolio during times of stress

‘Globalisation rewired’: what does it mean for investors?

After half a century of outsourcing production to developing nations, companies are changing tack – with long-term implications for investors

SocGen’s VAR up 33% in Q4

Gap with French rival BNP Paribas shrinks to just €9 million, the least since mid-2020

SEB’s market RWAs drop 20% as FX positions recede

Fall in currency exposures below EU’s threshold in Q4 reversed Skr5.3bn RWA hit from previous quarter

Navigating the volatility and complexity of commodity markets

Commodity markets have experienced significant challenges since the Covid-19 pandemic, the conflict in Ukraine and the subsequent sanctions imposed on Russia. These unprecedented events have caused fluctuations in supply and demand, disrupted global…

OTC share of EU gas derivatives surges to 25%

Energy price cap may supercharge flight from ETDs and affect CCPs’ ability to manage risks, Esma warns

Is low vol crowded? That depends who you ask

Equity drawdowns have pushed more investors into low volatility strategies, raising fears of a build-up of risk

BofA’s DVA losses inflated to $193m in Q4

Latest hit is largest since 2020, but still leaves positive result for 2022