Treasury inflation-protected securities (Tips)

How US shutdown set off long-awaited basis bet

Hedge funds dust off a years-in-the-making relative value trade to profit from fallback mismatch

US Treasury market preps for reporting showdown

Sifma expected to attack transparency plans; prop traders brand objections “crazy”

Foreign banks flocked to Treasuries and Fed in Q3

Claims rose at fastest annual pace since early pandemic amid inflation jitters

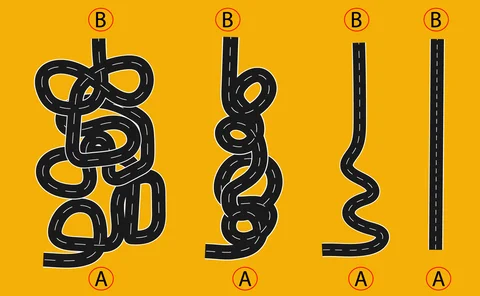

Hedge funds see appeal in inflation anomalies

Market has become less efficient and less self-correcting, funds say

CME said to have shelved inflation futures plan

Contracts had been drafted, but did not attract enough support

A year of market movement and trading opportunities

Sponsored forum: US inflation derivatives

Proshares ETFs offer Tips for protection

Proshares rolls out ETFs offering exposure to the difference in yield between Treasuries and TIPS

Inflation derivatives house of the year: Royal Bank of Scotland

Risk awards 2012

US inflation market divided on huge 30-year Tips short

When Tips don't pay

Morgan Stanley Tips bet 'made sense', dealers say

Big curve flattening bet attributed to Morgan Stanley was reasonable, traders say - one rival exited similar position just in time

Life companies try to meet inflation-linked product demand

Inflated needs

Inflation derivatives house of the year: Deutsche Bank

Risk awards 2011

Sponsored forum: US inflation derivatives

Developments in the US inflation derivatives market

Inflation options popular as investors look for protection

Popular protection

Korean linker volumes soar after introduction of deflation floors

The resumption of issuance of government linkers, which now include deflation floors, should aid the development of inflation derivatives in South Korea

US insurers and pension funds seek to hedge deflation

Extra inflation hedging demand driving split between derivatives and cash market pricing

Balancing correlation

Credit Suisse is offering US investors a 5.5-year structured product that is based on a basket that is balanced by the inclusion of the iShares Barclays Tips Bond Fund ETF. As well as proving to have low volatility, the fund is not correlated to the…

US inflation options sponsored forum: Recovery and development

The inflation market has had a challenging few months. In particular, many dealers were hurt by short positions in 0% inflation floors, causing sizeable losses for some firms. Sponsored by BGC Partners, Risk convened a panel of major inflation dealers in…

Losing the asset swap lifeline?

A price difference between inflation-linked and nominal bonds last year created a huge opportunity for real-money investors to benefit through asset swaps. Now the opportunity has diminished, how important are asset swap investors in providing inflation…