Trading platforms

FX traders sound alarm on tagging ‘abuse’

Front running and tag refreshing concerns abound on semi-anonymous trading platforms

Ice swap rate adds safety net with Tradeweb quotes

Inclusion of dealer-to-client prices will boost publication rate in stress periods, IBA claims

Volatile FX markets reveal pitfalls of RFQ

Clients urged to mask trading intent; critics warn of subtle sell-side advantages

Electronic bond trading stalled in volatile markets

Bid/offer spreads on bond platforms spiked in March and the buy side struggled to trade

Fee fight: dealers take aim at brokerage costs

Old tensions have new edge as banks urge clients to bypass platforms

FX aggregators flirt with scrutiny over brokerage charges

Making dealers pay for trades raises ‘payment for order flow’ questions

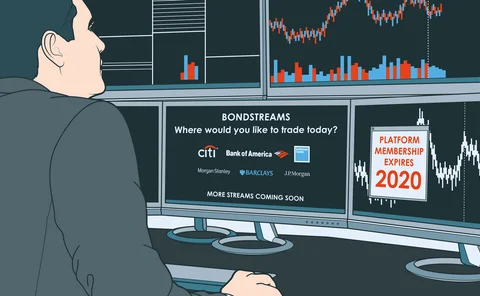

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Mifid’s free data mirage vexes markets

Users struggle to access post-trade data despite European regulator’s push for transparency

Tradeweb’s IPO shows how OTC markets are changing

RFQ pioneer is embracing new protocols and liquidity providers in a bid to connect the OTC markets

JP Morgan debuts Nexus spinoff for hedge fund exposure

Bank launches matchmaking service for lonely hedge funds and return-hungry investors

HKEX outage zapped key hedge; now banks push for rule change

Dealers seek shutdown of CBBC market if futures go dark

Buy side builds bots to cut trade costs

With margins under pressure, investment firms are looking to accelerate automation push

At bounding MarketAxess platform, a new CRO parses risk

Clarity and communication are basics to Oliver Huggins at one of the biggest US bond platforms

EC official: supervisors must manage Brexit trading disruption

Trading obligations won’t change, but Mifid-style forbearance possible in event of disruption

SEC mulls extra scrutiny of US Treasuries trading venues

Roisman suggests US might apply full rigour of Reg ATS to non-exchange Treasuries platforms

Tradeweb reveals package trading for swaps and bonds

New tool offers pricing and trading of sterling swap-bond combo

FCA chief calls for EU to extend Brexit clearing exemption

Bailey also urges EU to grant equivalence determinations for UK trading venues

Buy-side trading system of the year: MarketAxess

Asia Risk Technology Awards 2019

Esma probes blurry line between FX vendors and venues

Forex liquidity aggregators resemble trading platforms – but are not regulated as such, critics charge

IBA mulls RFQ data and Sonia spinoff to bolster swap rate

Benchmark administrator consults on plan to reduce non-publication and prepare for transition to RFRs

Trading venues could help enforce the forex code

ECNs have the power to boost last look disclosures, but aren’t keen to be the code police

How the top 50 dealers tackle forex last look

Uneven disclosure practices are making life difficult for agency algos and ECN trading

UBS unleashes Orca for rates clients

Machine learning algo trawls liquidity pools to slash US Treasury trading costs

Brexit nudges Trad-X swaps service to Paris

London loses out on planned dealer-to-client Clob for OTC euro interest rate swaps