Tax

Complying with climate risk framework standards for streamlined processes

Conscious that climate change affects all sectors of the economy, financial institutions are realising the significant impact this will have on their customers and, ultimately, their own profit margins.

Podcast: Leveraging real‑time data feeds for faster business decisions

The markets have been on a very volatile ride in 2022, which makes low-latency data more crucial to the business

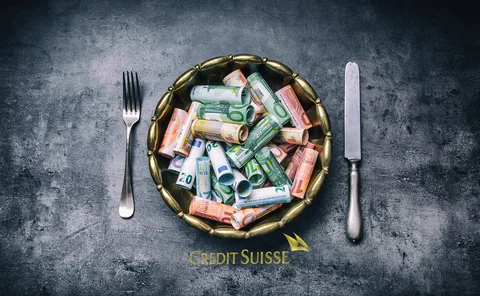

Op risk data: Dodgy tax practices cost Credit Suisse €240m

Also: Binance blockchain hack; ING’s Polish AML fail. Data by ORX News

Hyperautomation in anti-financial crime: powering transformation

This report explores the need for banks to invest in AFC operations that are more effective and efficient

Leveraging data in e-FX trading

A white paper explaining how, in a world where electronic trading has infiltrated virtually every aspect of today’s FX market, having access to data and the means to interpret it are fundamental components of a successful e-FX strategy

Fighting financial fraud with AI

Risk and compliance professionals convened for a Risk.net webinar, How to successfully mitigate fraud – AI in action, in association with NICE Actimize to debate the use of artificial intelligence in the fight against fraud

Funding adjustments in equity linear products

How tax asymmetries and Tobin tax affect the pricing of total return swaps

Carbon tax spike could spur global recession – S&P

Higher carbon prices would trigger widespread industry defaults, says agency research unit

Tax windfall at Crédit Agricole to fund capital shake-up

Relief for Emporiki sale bolstered CET1 capital ratio +40bp

Opening the buy-side liquidity pool

Vikash Rughani, business manager at triReduce and triBalance, outlines a new approach enabling buy- and sell-side participants to optimise the transition of legacy Libor over-the-counter swaps contracts to alternative reference rates

The digitisation of legal negotiations and data

In partnership with Risk.net, specialists from AcadiaSoft, Linklaters, and the International Swaps and Derivatives Association weighed in on the digitisation of derivatives documentation for a virtual roundtable discussion. Recent innovations, aimed at…

Politicians must heal a fractured UK society

Political journalist Robert Peston has grave concerns over the future of Britain, seeing profound risks with or without Brexit

An investigation of cyber loss data and its links to operational risk

This paper investigates cyber loss data and focuses on quantifying the direct financial and compensatory losses emanating from cyber risks.

Deploying agile analytics in the fight against fraud

Financial firms are under pressure to tackle the widespread problem of financial fraud. As the speed, scale and sophistication of fraudulent activity grows, a panel of financial crime experts reveal how firms can develop an agile analytics capability to…

Libor transition and implementation – Covering all bases

Sponsored Q&A

ETF investing – Building better portfolios

At the Asia ETF Forum 2019, Hong Kong Exchanges and Clearing (HKEX) welcomed industry experts from around the region to six key Asian exchange-traded fund (ETF) cities, offering attendees an updated view on the growing ETF market in Asia. This article…

Risk premia strategies – Lessons learned for the future

After a difficult 2018, investors are increasingly wary of risk premia, concerned that factors leading to underperformance might be a recurring problem. Imene Moussa, executive director at UBS, clarifies this issue

US Treasury won’t issue SOFR notes until at least 2020

Project Titan will delay issuance of floating rate Treasury notes linked to new reference rate

Extending the ETF frontiers: Institutions are finding new ways to use ETFs

Growing institutional adoption of exchange-traded funds (ETFs) has been an undeniable trend over the past few years. In this article, Hong Kong Exchanges and Clearing (HKEX) explains why institutions are increasingly using ETFs to gain targeted exposure,…

Profit emergence under IFRS 17

Major changes are expected under the new IFRS 17 regime – insurance companies must make efforts to comprehend and communicate the full impact of changes to profit emergence under different scenarios, and its sensitivity to different methodology choices,…

Growing an institutional footprint in Asia’s ETF market

Hong Kong Exchanges and Clearing (HKEX) explores the burgeoning impact of institutional investors in Asia’s exchange‑traded funds (ETFs) market – which is demonstrating the potential to establish itself as a global force – with a focus on the rapid…

Industry fears EU ‘Google tax’ will hit trading venues, CCPs

Broad wording of digital services tax could place market infrastructure in firing line