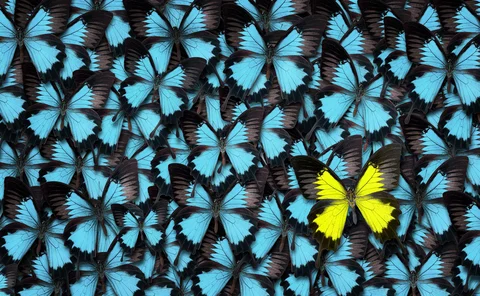

Tail risk

Banks shock commodities by 1,000% in stress-test rethink

Energy price spikes force clearing firms to consider extreme or even ‘implausible’ scenarios

Boosting the ESG exposure of a low‑risk portfolio

Nikolay Radev, senior quantitative researcher at FactSet, discusses the limitations of previous environmental, social and governance (ESG) measurement, and proposes a new approach to optimising ESG exposure in minimum tail-risk (MTR) portfolio…

‘Corrective’ algo tells quant firm when it’s wrong

QTS has built a machine to show whether a strategy is likely to succeed or flop

Trend following’s bumper returns mask fading convexity

Research suggests strategy is no longer a reliable hedge against stock market crashes

Inflation scenarios, pt II: end of the party

Whether inflation rises or falls, crowdsourced scenarios forecast huge range of outcomes

As geopolitical risk spikes, a major index gets a revamp

Geovol risk gauge built by Nobel laureate Robert Engle to become Global Covol

Banks tout CCAR-style stress tests for emergent risks

Extreme-but-plausible scenario planning is being applied to geopolitical events such as Ukraine conflict

Bank of America’s VAR drops 19% in Q4

Average one-day trading VAR falls to lowest point since Q1 2020

Buy side turns to extreme value theory to spot tail risks

Asset managers reappraise decades-old technique to gauge downside risks amid fears of volatile 2022

CCPs unlikely to be wiped out by op losses, research suggests

Former LCH risk chief says sharing loss data would help CCPs avoid risk of holding too little capital, or too much

Prudential CRO: markets haven’t priced in tail risks

Risk USA: distribution of extreme outcomes “has gotten broader and wider”, says Nick Silitch

An examination of the tail contribution to distortion risk measures

This paper reports a method for analyzing the influence of the tail in calculations of distortion risk measures.

Procyclicality control in risk-based margin models

This paper revisits the procyclicality issue in risk-based margin models and provides additional insight on procyclicality mitigation techniques.

Is short vol taking the long count?

Short volatility players try to box clever after strategy’s Covid rout

Fed economist sounds alert over op risk capital arbitrage

Insurance payouts could allow banks to pare back capital without equivalent reduction in risk, says paper

Quants pitch strategies for when bonds no longer work

Investors are flocking to alternative diversifiers of equity risk

Hedge fund of the year: Saba Capital Management

Risk Awards 2021: Credit specialist proved its worth in the Covid crisis

Research house of the year: Societe Generale

Risk Awards 2021: Quant group’s tail-risk hedging strategies ‘saved the books’ of some big clients

Quant investment firm of the year: Nordea Asset Management

Risk Awards 2021: Focus on tail risk – and a little ice in the veins – helped Nordea stare down Covid

Body and tail: an automated tail-detecting procedure

The quality of a tail model, which is determined by data from an unknown distribution, depends critically on the subset of data used to model the tail. Based on a suitably weighted mean square error, the authors present a completely automated method that…

Fund size and the stability of portfolio risk

This paper examines the relationship between portfolio size and the stability of mutual fund risk measures, presenting evidence for economies of scale in risk management.

Federated Hermes’ Murray on psychology and risk management

Buy-side risk survey: top executive talks about learning from Daniel Kahneman and client behaviour

Alt risk premia chasing 'tail beta' – again

Quant strategies that failed in the coronavirus crash face a reckoning

Procyclicality mitigation for initial margin models with asymmetric volatility

In this paper, we explore the procyclicality of initial margin requirements based on VaR volatility models.We suggest procyclicality can be reduced using a three-regime model rather than using ad hoc tools.