Systemic risk

European legislators to exempt CCPs from new bank rules

Support in Council and Parliament suggests leverage ratio, NSFR exemptions will be in final text

Credit data: Brexit gloom lifting for UK companies?

David Carruthers of Credit Benchmark looks at the most recent trends in bank-sourced credit data

CCP stress tests have found capital shortfalls – Esma

Small increases to stress-test scenarios would have left Ice Clear Europe “in material breach”

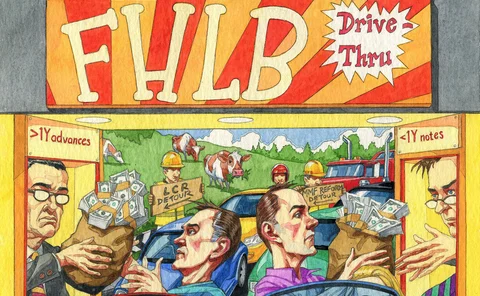

Soaring Fed Home Loan Bank borrowings spark systemic risk fears

Parallels drawn with Fannie and Freddie as commercial bank borrowing from FHLBs nears $500bn

Identifying complex core–periphery structures in the interbank market

This paper proposes a framework to identify the structure of a financial network and its evolution over time, and presents an application to an interbank market with complete actual data.

JP Morgan urges clients to compress over G-Sib fears

Bank trying to mitigate impact of draft Federal Reserve rule change on clearing business – others are said to be doing the same

DTCC set to cut US Treasury clearing fees

Revised fee structure could prompt more firms to participate in clearing

SEC approves DTCC’s $74bn liquidity facility

Proposal faced opposition from smaller broker-dealer members of US Treasuries CCP

JP Morgan’s CRO on the bank’s six buckets of risk

Risk30: From loan losses to electromagnetic pulses, JPMorgan Chase has a place for it

JP Morgan CRO: CCPs need extra tail-risk buffers

Bail-in capital would help avoid contagion, says JPMorgan Chase's Ashley Bacon, in an interview with Risk.net

Fishing for Sifis: row over Nobel laureate’s risk model

Engle’s tool for ranking risky firms is one of many that are dividing industry, academics and regulators

Prudential’s Silitch on the blindspots in Basel III

Risk30 profile: Post-crisis reforms have failed to fully address systemic risk, Prudential’s CRO warns

IMF ‘wrong’ to label Deutsche world’s riskiest bank

Co-developer of risk methodology used by IMF says it was misapplied when labelling bank riskiest G-Sib

Crisis alert: new model aims to give early warning of downturn

Academics say tool could offer policymakers up to three years’ notice of impending crash

Fed supervisor presses banks to address CCP exposures

Regulator says more information is needed to fully understand the risk of cleared trades

US Treasury’s research arm revamps systemic risk models

New approach from OFR relies on separate measures of stress and vulnerability

Cyber risk a top threat for energy firms

Cyber crime cited among top three external risks; scarce data makes modelling difficult

US Treasury hands CCP resolution powers to FDIC

Mnuchin regulatory review explicitly refers to FDIC as receiver under a Title II resolution

Systemic risk management in financial networks with credit default swaps

In this paper the authors study insolvency cascades in an interbank system, in which banks are permitted to insure their loans with credit default swaps sold by other banks.

US blocking new list of global too-big-to-fail insurers

US wants designation suspended until new, activities-based approach is ready

Behavioral risks at the systemic level

By comparing the Libor and FX benchmark manipulation scandals, this paper describes how misbehavior emerged independently in both of these markets and the conditions that permitted the misconduct to survive and thrive.

CDS surcharge touted to aid systemic stability

Charges would encourage systemic banks to buy protection from less significant players

Fed official voices support for simpler capital regime

US regulators may consider combining some capital ratios into a single measure

This tangled web: banks seek to contain systemic model risk

Network studies are being used to identify model dependencies and concentrations