Swaptions

Hedge funds turn to curve options for steepener trades

Previous bets on US interest rate curve flopped following unexpected flattening

Formosa swaptions trade under pressure from new Taiwan rules

Limit on investment by insurers is hitting issuance of Formosa bonds and related options

Brexit threatens some swaptions trades

Force majeure clauses could be triggered on physically settled contracts

Eonia woes hold up euro swaptions switch

Eleventh-hour derailment for project that has been in the works for a year

Swaptions vol modelling tweak opens up pricing possibilities

Nomura quant proposes local volatility model that can directly calibrate to swaption smiles

BAML replaces head of global rates

Gupta and Stanley named co-heads as Roberts exits

Swaptions CCP basis arrival raises wider valuation questions

Halting rollout of new prices highlights potential weak points in valuing illiquid products

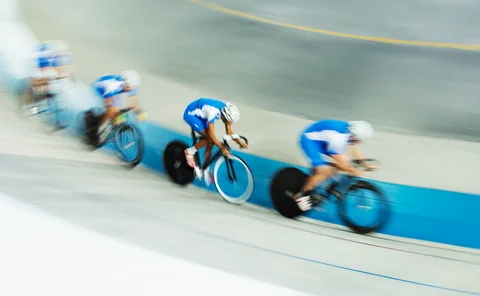

Putting swaptions pricing in the fast lane

Derivatives consultant proposes a model for arbitrage-free pricing

Podcast: Roos on swaptions arbitrage and benchmark reform

Benchmark reform means additional work for rates quants

Discrete time stochastic volatility

Quant proposes faster model to price arbitrage-free swaptions

Vol virus: how a CCP basis leapt from swaps to swaptions

A clearing house basis has opened up between JSCC and LCH on yen swaptions – despite neither clearing the product

Broker hid yen swaptions basis after trader backlash

Japan’s Totan had been first to show volatility basis; sources speculate traders wanted to avoid re-marking books

US swap rate failed during volatility rout

The Ice swap rate was not published on February 6 due to a lack of electronic prices during equity turmoil

Cash no longer king in European swaptions

Barclays executives explore weaknesses of current pricing formulas for cash-settled swaptions

Euro swaptions market prepares for pricing revamp

Interdealer market to adopt collateralised cash price from July, but some fear impact on legacy books

Clearing conundrum – Forging a solution for the bilateral market

Central clearing has had a beneficial effect on the over‑the‑counter derivatives market, but for some products the road to a cleared model has not been smooth. Capital, operational and margin costs of the non-cleared market have increased, while…

Swaptions expiries complicate portfolio optimisation runs

triBalance and Quantile users call for better post-trade co-ordination between dealers

Industry renews push for triBalance clearing exemption

Dealers using Emir review to request carve-out for optimisation trades

A nonparametric local volatility model for swaptions smile

This paper proposes a nonparametric local volatility Cheyette model and applies it to pricing interest rate swaptions.

Banks turn to synthetic derivatives to cut initial margin

Options-based instruments can halve initial margin for some non-cleared products, say dealers

Bounding Bermudans

Thomas Roos derives model-independent bounds for amortising and accreting Bermudan swaptions

Formosas, the Fed, and the billion-dollar Bermudan trade

Rates options desks on alert as decline in Formosa bond issuance could hit profits and raise US volatility

Monthly swaps data review: Libor dominance challenged

There are more sources of over-the-counter derivatives data available today than at any point in the market’s history

XVA at the exercise boundary

Andrew Green and Chris Kenyon show how the decision to exercise an option is influenced by XVAs