Structured products

WHAT IS THIS? Structured products are investments that have multiple components. For retail investors, the most common form is a bond plus an option – these tend to be standardised, sold in small tickets and large volumes. Managing the risks of large structured products portfolios is one of the biggest challenges dealers face.

Incapital acquires Blue Sky Asset Management

US investment bank and structured products specialist Incapital will takeover UK distributor Blue Sky Asset Management. Blue Sky's book of plans will be subsumed into Incapital Europe

Swiss structured products and ETF volumes see sharp decline in June

Trading and turnover volumes in the Swiss structured products and ETF markets fall in June after seeing gains during the start of the year

S&P launches quality ranking indexes and licenses to PowerShares

Standard and Poor's has extended its index range to include quality rankings indexes, one of which has been licensed to Invesco PowerShares, and has added sector indexes in its CDS Index family

FTSE strengthens global business with executive hires

FTSE Group has added to its London office with the recruitment of five senior executives

South Korea implements product pre-approval regulation

South Korea launched its new derivatives product approval system in June but issues remain

McLaughlin joins law firm Fried Frank in New York

US law firm Fried Frank has hired Robert McLaughlin, co-founder of the structured products practice at Katten Muchin Rosenman

Volatility helps German structurers offer attractive returns

The problems in the eurozone are unleashing volatility across the continent's indexes, thereby making it easier for bankers in Germany to offer good coupons on autocallables

Vanguard creates ETFs on equities, fixed income and property

Vanguard has increased its US ETF offering with the addition of a host of new products based on the benchmark S&P 500 and Russell 2000, and including equities, fixed income and property

UK ETF investors abandoning FTSE 100 in favour of global indexes

The balance of UK investments in ETFs has shifted from the FTSE 100 index towards ETFs based on the S&P 500, MSCI Emerging Markets and Japan in the first quarter of 2010.

Citi strengthens emerging markets equity derivatives team

Citi has added four new hires to its CEEMEA operations as its equity derivatives platform pushes into emerging markets.

FDIC will apply lower deposit limits to products in circulation

If the US congress votes to lower the deposit insurance limit to $100,000, then that figure will count for products currently in circulation, says the FDIC

Petrone rejoins Citi as head of capital markets

Citi Private Bank in New York has named Thomas Petrone as head of capital markets, with responsibility for the bank's ultra-high-net-worth clients

BNP Paribas snares Quentin Renaud from SocGen for MTNs and structured products

BNP Paribas has added Quentin Renaud to its London-based global MTN trading desk

FTSE indexes track firms' carbon exposure risk

Two new carbon indexes will enable investors to make investment decisions based on how carbon reduction schemes affect company earnings

RBC offers exposure to BP through structured products

Royal Bank of Canada has issued a new reverse convertible based on BP. The oil company's shares have risen in the US market in recent trading despite hitting a 13-year low on the London Stock Exchange

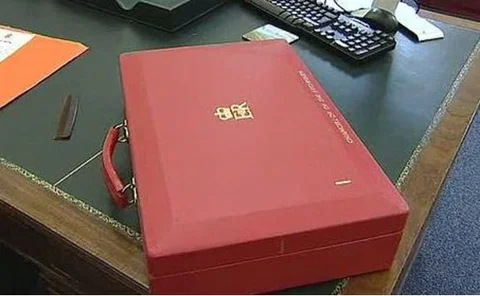

Capital gains tax reprieve cheers investors amid budget gloom

The less-than-expected increase in capital gains tax announced by UK chancellor George Osborne means structured products retain their tax-efficient status

Brokerage expands renewable fuels capabilities

Evolution Markets expansion targeted to respond to growing demand for alternative energy sources

US wrap: Eurostoxx 50 proves popular

The European benchmark index continues to feature in this month's issuance