Stress-testing

Ten US banks fail Geithner's stress tests

Daily news headlines

Tarp banks rush to repay to avoid regulatory scrutiny

Daily news headlines

Basel Committee addresses stress testing

Daily news headlines

FSA plans reverse stress tests

Daily news headlines

Pushed to the limit

Stress Testing

Fully flexible views: theory and practice

Attilio Meucci proposes a unified methodology to input non-linear views from any number of users in fully general non-normal markets and perform, among others, stress testing, scenario analysis and ranking allocation. He walks the reader through the…

FSA urges firms to improve stress testing

FSA's FRO 2007 warns of a greater impact of event risk if stress tests not improved.

FSA proposes a model for stress testing

Regulator’s thematic review suggests a way to embed stress testing into the risk management framework.

The misdirected directive?

Germany's financial regulator, BaFin, tried to steal a march on its European rivals by implementing a new directive that should open the door to asset managers investing in new products and using over-the-counter derivatives. But did it get it wrong?

Basel harmony still a long way off, notes IIF

“No-one really appreciated the complexity of the whole [Basel Accord] process,” says Charles Dallara, managing director at the Institute of International Finance (IIF). “It is only in the last nine months that regulators and bankers have woken up to the…

Risk manager of the year - Richard Evans, Deutsche Bank

The head of group market risk's stress-testing approach has helped transform Deutsche Bank.

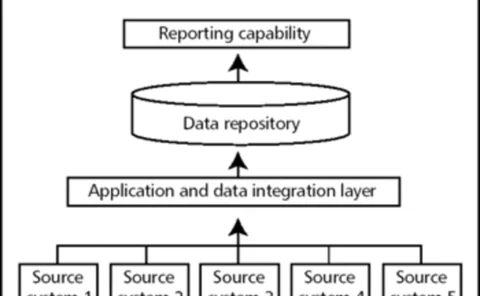

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Correlation stress testing for value-at-risk

The correlation matrix is of vital importance for value-at-risk (VAR) modelsin the financial industry. Risk managers are often interested in stressing a subsetof market factors within large-scale risk systems containing hundreds ofmarket variables…

Running a smooth operation

Technology

Stress testing is the best option to counter Basel II cyclicality problem, say regulators

BASEL – Global banking regulators said stress testing of internal ratings based (IRB) methods of measuring bank credit risk is the best option in terms of tackling the possibility that the complex Basel II bank capital accord could reinforce economic…