Securitisation

FSB's predecessor 'failed miserably' ahead of crisis – Andresen

Secretary general says FSF failed to act on known risks surrounding resolution and securitisations

FRTB: the nightmare before Christmas

Unwanted gift will be delivered, say regulators, and only its size is up for debate

Southern Europe securitisation markets thrown lifeline in EC plan

New rules ease treatment of ABS from countries with low credit ratings

Solvency II changes among ‘first actions’ in EU markets plan

Leaked document suggests intention to act quickly on infrastructure and ABS

Q&A: Visco of Bank of Italy on bank reforms and supervision

Splitting off prop trading would ‘complement’ EU resolution regime

Securitisation turnaround is causing confusion

Regulation has failed to keep up with a change of heart from policy-makers

Moody's swaps bail-in bet splits banks and buy side

Asset managers wary of assumptions that make swap counterparts look stronger

EU urged to go it alone on capital for securitisations

Basel group split over how to reflect European plans for 'simple' securitisations

EU supervisors want better data, securitisation stress tests

Better disclosure requirements could allow investors to perform tests

RBS launches second DPC to prop up swaps

Boom-era vehicle retooled to guarantee securitisation hedges

Lawyers tout fixes for CLO risk-retention woes

Affiliates and warehouses could satisfy both US and EU risk-retention rules, lawyers claim

Nationwide: ABS markets need more than warm words

"There does seem to be this sense in which covered bonds are innocent until proven guilty"

Hedge funds, securitisation and leverage change P2P game

The institutionalisation of P2P lending is creating new risks, critics warn

Q&A: Benoît Coeuré, ECB, on securitisation and clearing risks

Revamped ABS market will need state support if it is to be a game-changer for Europe

You win some, you lose some

Regulators cannot always be as tough or as lenient as they would like

Eaglewood sees online platforms as future of lending

Eaglewood Income Fund up 9% to June 2014

Eiopa out of touch on securitisation, say experts

Bernardino says charges workable, but industry disagrees

Investors poised as banks weigh fixed-income spin-offs

Ultra-high-net-worth investors ready to sink $300 million into market-making revolution

Credit fears hold back US solar securitisation deals

SolarCity deals show potential and pitfalls of new asset class

ECB calls for lighter treatment of high-quality ABS

Bank of England and ECB to promote coherent approach to ABS regulation

Cuts to securitisation capital charges too small, say experts

But European Commission proposals can stop insurers becoming forced sellers of low-risk securitisations

Basel securitisation rules revisions criticised

While the December proposals incorporate many of the industry's comments, banks claim the rules are still too harsh

Basel gives on securitisation capital – but industry still unhappy

Proposals on proposals

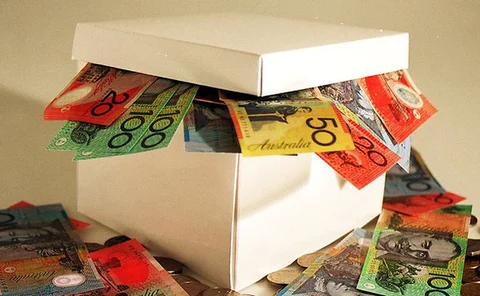

Bank funding options increased under revised Australian securitisation framework

Increased funding options welcomed in the face of a potential spike in Australia consumer credit growth