Risk-weighted assets (RWAs)

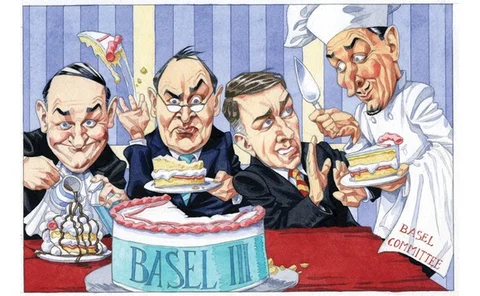

Basel III takes a bite out of aircraft and shipping finance

On the scrapheap

Different preferences create divided implementation of Basel III

A matter of taste

Regulatory differences could be behind RWA inconsistency, report suggests

Initial findings of a review led by the European Banking Federation suggests differences in regulatory regimes could be behind a divergence in RWA numbers

Bank capital

In depth: bank capital introduction

SIG to keep an open mind on RWA probe, says Himino

The Basel Committee’s standards implementation group has begun an investigation into RWA consistency, but chair Ryozo Himino says there might be good reasons for discrepancies

Basel 2.5 caused €200 billion jump in RWAs

European banks saw their RWAs leap at the turn of the year, as new trading book rules collided with the EBA's call to achieve a 9% capital minimum

RWA probe could cut modelling flexibility, says new Basel chief

A stricter approach to the modelling of bank capital is "high likely", as a result of concerns that risk-weighted asset numbers are too divergent

Del Missier: "status quo won't work" for long-dated trades

Dealers will have to change the way they approach long-dated derivatives business, says Barclays Capital’s Jerry del Missier

Credit derivatives house of the year: Deutsche Bank

Risk awards 2012

Credit portfolio manager of the year: JP Morgan

Risk awards 2012

Asia’s opinions on Basel III

The Basel Committee has published rules on the capitalisation of bank CCP exposures and global Sifis in recent months. It will now monitor how the rules are implemented, and tweak calibrations where necessary. Asia Risk talks to a selection of leading…

Q&A: Stefan Walter on Basel III, RWAs, 'anti-American' rules and CVA

“It’s good to have hard deadlines”

Risk USA: Regulators need to be wary of capital overshoot, says Roldán

Adding to Basel III capital levels might have unintended consequences, says former chair of Basel Committee’s standards implementation group