Risk management

Nuclear stockpile

The US Nuclear Regulatory Commission has come under fire for not adequately monitoring the decommissioning funds of nuclear power plants. But the NRC says the criticism is unwarranted. By Paul Lyon

Protection treaty

Matthew Saunders , of law firm DLA, introduces the bilateral investment treaty which, though often overlooked, can be an effective method of affording legal protection for energy investments and minimising energy project risk

Capital calculations

The latest Committee of Chief Risk Officers white paper offers capital adequacy guidelines for energy merchants. But why should energy firms perform these calculations? Glyn Holton asks whether the CCRO has missed the point

Bound by the rules

New frontiers

Back to basics

New frontiers

Degreasing palms

New frontiers

The diligent diversifier

Profile: University of North Carolina

Reporting: a better performance measure

Data monitoring

The hedge fund index quagmire

Indexes

Take the index high road

Portfolio management

Wealthy Europe gears up with hedge fund exposure

Wealth management

Crunch time for prime brokers

Germany

Dealing with hedge fund risk

Contents

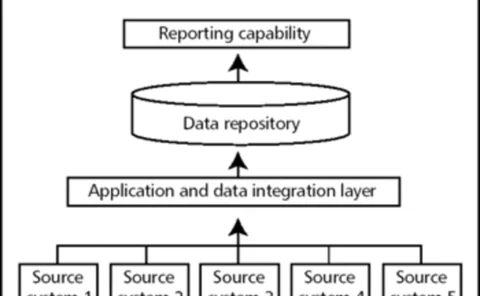

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Farms weather power shortages

Farmers in both hemispheres are struggling to cope with heat waves and droughts while pondering the prospect of future power supply disruptions, finds Maria Kielmas

Scrutiny of the bounty

Introduction

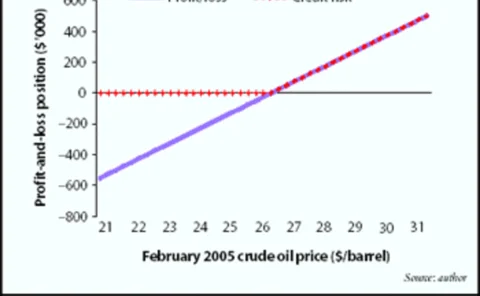

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

Deciphering drawdown

Risk measurement

Flushing out the fraudsters

Hedge fund fraud

Energising returns

Energy trading

Hedge fund tricks or treats?

Trading practices