Reinsurance

Variable annuity sales recover in Japan as insurers revise hedging strategies

Simplified product design and buoyant equity markets combine to revive Japan VA market

Aviva longevity swap raises questions for intermediaries

Insurer goes direct to reinsurers for £5 billion pension scheme risk transfer

Stochastic modelling of reinsurance credit risk

Stochastic modelling of reinsurance credit risk

Reinsurance sidecars evolving as competition for third-party capital hots up

Sidecars mimicking ILS funds to lure investors entering collateralised reinsurance space

Renewables expected to drive demand for weather derivatives

Weather risk management firms predict renewables and thinner energy market liquidity will drive growth

Insurers target value-in-force monetisation transactions to boost regulatory capital

But securitisations still a challenge, say experts

Banks offer combined reinsurance and hedging solution to Japan VA providers

Following risk management failures in the financial crisis, Japanese variable annuity providers’ new VA offerings include conservative investment objectives and sophisticated hedging strategies, combined with reinsurance

US funds seeing ‘increasing demand’ for pension risk management

Pension funds in the US are becoming increasingly aware of the need for pension risk management and pension risk transfers, as new pension regulations are implemented

Suncorp’s risk controls and ops face up to Queensland floods

Withstanding disaster

Scor eyes UK pension funds’ longevity risk

Reinsurer Scor becomes the latest firm to enter the longevity arena

Mexico and Brazil on the road to risk-based regulation

Latin American economic powerhouses Brazil and Mexico are introducing new solvency regulations in their fast-growing insurance markets. But while Mexico has gone straight for a Solvency II-type approach, Brazil is emphasising gradualism and will not make…

E&P energy company premiums likely to rise

Energy exploration and production (E&P) companies face increased cost risks as insurance premiums could rise, following BP’s Gulf of Mexico oil spill, which forced reinsurance firms, such as Germany’s Munich Re, to shell out hefty payments

Cat bonds set to become new face of structured credit, say Axa chiefs

Two senior heads at Axa Investment Managers anticipate escalating demand for catastrophe bonds.

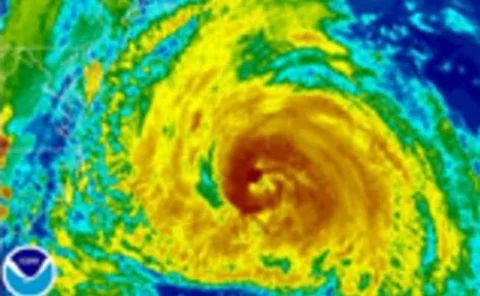

Aon Benfield launches first pan-Asian typhoon model for cat risk

Two companies offer new insurance products covering typhoon catastrophe risk in Asia

Aon takes a measured approach to GRC implementation

Aon Corporation, a global provider of risk management services, insurance and reinsurance brokerage, has opted for a more measured approach to adopting a GRC platform by starting with an upgrade of its existing Sarbanes-Oxley (Sox) compliance system and…

Cat bonds return

The market for catastrophe bonds dried up in 2008 and early 2009 as the financial crisis took its toll. Confidence is returning, helped by wide spreads and a re-think about the assets used to collateralise catastrophe bonds, but issuance has yet to…

Solvency management provides reinsurance opportunity

Testing economic conditions have prompted widespread moves by life insurers to reinsure their liabilities in order to gain capital relief. As the situation eases, will demand for reinsurance fall, or are other factors coming to prominence? Blake Evans…

Staying out of harm's way

Catastrophe Bonds

Insurance Risk Manager of the Year - Hannover Re

Risk Awards 2008