Prime brokerage

Trouble in the family: regulators’ options after Archegos

What rule changes are needed in response to the messy collapse of Bill Hwang’s firm?

Could an Archegos blindside banks in Europe? Not really

Archegos’ banks were burnt by its hidden US swaps – in much of Europe, they would have to be public

How Credit Suisse fell victim to its own success

Roots of Archegos loss can be traced to business strategy the bank embraced back in 2006

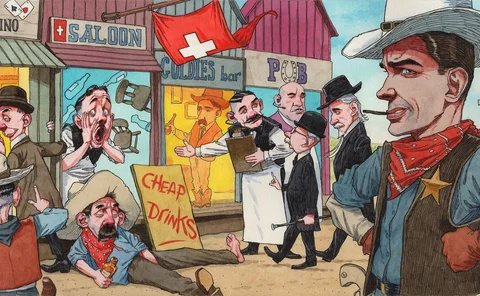

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

BNP Paribas’ VAR hit 12-year high in Q1

Equity portfolio VAR surged 27% quarter on quarter

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

After Archegos, Credit Suisse clients tap rivals for clearing

Swiss bank is said to have lost clearing business amid uncertainty over its future

Morgan Stanley’s VAR hit eight-year high in Q1

High risk-of-loss indicator coincides with Archegos collapse

Would margin rules have checked Archegos? Perhaps not

Regulator-prescribed margin methodology permits six-times leverage on equity swaps

Foreign exchange prime broker of the year: HSBC

Risk Awards 2021: Diligent approach to risk management brings new clients to UK bank

Dealers drag their feet on NDF clearing, say prime brokers

Trade mismatches and other wrinkles hinder clearing between executing broker and prime broker

Basis trades: a test case for regulating risky activities

FSOC is right to focus on dangerous behaviour, but Treasury meltdown reveals a complex chain of actors

PBs seek remedy for credit addiction in FX

Group set up after big Citi loss considers limit-checking hub, among other options

Citi promotes Perkins and Wilson to top clearing post

US bank creates clearing co-head role in wake of Kemp’s retirement

BofA becomes first US bank to adopt SA-CCR

Move cut leverage exposure by $66bn, but other banks wary of trade-offs

RMB hedging comes onshore as regulators liberalise FX market

Foreign investors turn to CNY for bond hedges as rule changes spur more competition

BNP buys Deutsche’s delta one assets in latest CRU auction

French dealer lodges winning bid after missing out on flow equity portfolios last year

Will uncleared margin rules change the FX landscape?

As the next phases of uncleared margin rules come into force, there will be an economic driver for more clearing of FX. By Phil Hermon, Executive Director of FX Products at CME Group

Foreign exchange prime broker of the year: HSBC

Risk Awards 2020: UK bank manages risk in real time, while building tool to cut exposures up to 80%

JP Morgan debuts Nexus spinoff for hedge fund exposure

Bank launches matchmaking service for lonely hedge funds and return-hungry investors

Prime services – It’s about what you bring

There are many benefits to integration – particularly when it comes to the provision of prime services. Societe Generale has followed this path, which has allowed it to improve cost efficiency and improve the range of products it can offer. The bank has…

Clearing bank of the year: JP Morgan

Asia Risk Awards 2019

How collateral scarcity reshaped the US yield curve

QE and demand for high-quality liquid assets have suppressed short-term rates, argue IMF economists

BAML leads US G-Sibs on swaps exposures to hedge funds

Bank has seen net current credit exposures to hedge funds rise 231% in three years