Portfolio theory

International and temporal diversifications: the best of both worlds?

In this paper, the authors focus on seven stock market indexes: two US, three European, one emerging and one Japanese. They select different pairs of markets and, with the help of wavelets, decompose these series at different timescales.

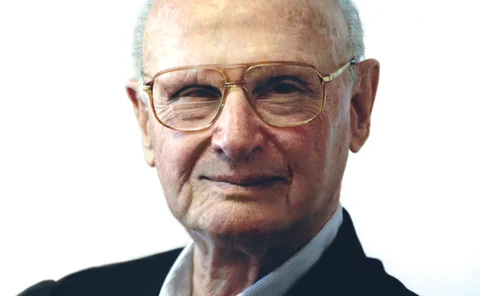

Markowitz attacks hedge fund diversification claims

Nobel prize winner Harry Markowitz says alternative investments may not deliver the diversification benefits sought by investors

Applying modern portfolio theory to optimal gas purchasing

Yijun Du and Xiaorui Hu present a general framework for applying modern portfolio theory to optimal natural gas procurements. They show that successful natural gas procurement involves determining the optimal allocation between fixed-price and floating…

The long and the short of it

Investment management

Value under liquidation

Liquidity