Over-the-counter (OTC) derivatives

Asia collar financing surges on back of Covid-19 volatility

Options-based structures gain ground on margin loans – and dealers say it may be a structural shift

Clearing banks show they’ve learned lessons of the past

CCP members were able to meet massive margin calls in March. But could they do it again?

EU’s Brexit clearing grab slow to lift off

Clearing members say clients aren’t transferring material volumes from LCH to Eurex rapidly

‘Improving’ Mifid post-trade transparency splits markets

Mooted changes to Europe’s transparency regime are dividing markets – largely along functional lines

Antitrust fears cloud Isda protocol – and fallback spreads

Wait for DoJ assurances could delay Libor transition plans and further unsettle rates trading

FCMs feared systemic incident during March back-office meltdown

Trade breaks following Covid-19 spike in futures volumes required massive clean-up job, says BofA exec

LCH debuts central clearing for Sora derivatives

CCP expects surge in volumes after clearing first trade linked to Singapore’s risk-free rate

EBA relaxes modellability hurdles for market risk capital

Flexibility granted for assessing NMRFs on options, but constraints remain on committed quotes

FVA losses back in spotlight after coronavirus stress

Three US banks suffer combined loss of almost $2bn after rates and funding double whammy

Industry calls for suspension of IM compliance dates

Associations warn phase five deadline may no longer be possible for hundreds of buy-side firms amid Covid-19 disruption

Systemic US banks shed more than $7trn of non-cleared swaps in 2019

Cleared notionals stay flat on the year

India preps margin regime as parliament debates netting law

Lawmakers thrash out bill on close-out netting; margin rules likely to follow in H1

Oil price shock triggers big margin calls

Banks and exchanges worked through weekend in anticipation of oil collapse

Equity, Treasury collateral builds up at US G-Sibs

Fair value of equity collateral rises 19% year-on-year

Outsmarting counterparty risk with smart contracts

A digital transaction system developed by quants at DZ Bank could slash margin costs for derivatives

Smart derivative contracts: detaching transactions from counterparty credit risk

Introducing deterministic termination rules to eliminate counterparty risk in smart derivatives

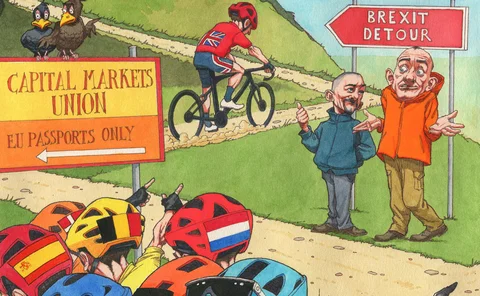

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Citi shed over $32bn of counterparty exposures in Q4

Risk-weighted assets for CCR exposures dropped -12%

CDX on junk bonds jumped 65% in H1 2019

Notionals to which CCPs were counterparty increased +85%

Swaps exposures of US G-Sibs dropped 12% in Q4

Net current credit exposures hit $474.8 billion by year-end

Scotiabank takes C$116m XVA charge

Introduction of centralised valuation platform altered fair value of uncollateralised positions

Clearing members in cash clash with Apac CCPs

Banks and clearing houses wrangle over who should pay for losses on invested collateral

Worth the cost? EU rethinks Mifid disclosure rules

Banks would gladly be rid of cost disclosures, but some clients want them improved, not scrapped

As business mix shifts, Eurex bulks up its default fund

Clearing house will raise charge to 9% from 7% as stress tests signal need for a fatter fund