Over-the-counter (OTC) derivatives

Corporates fear CVA charge will make hedging too expensive

Crunch time for corporates

Profile: Credit Suisse's algo team on automating OTC markets

Automating OTC

LCH.Clearnet eyes November launch for NDF clearing

London-based CCP is set to launch clearing for NDFs in six currencies in mid-November, having shelved plans for options clearing while banks discuss settlement-related issues with regulators

Canadian OTC derivatives repository unnecessary, say market participants

Critics argue a Canadian OTC derivatives repository would lead to fragmented and inconsistent data

Greater focus on OTC derivatives op risk required in Asia – Celent

Market participants in Asia need to focus more on operational risks associated with their resurgent OTC derivatives trading volumes, especially as the market moves towards trade repositories and central counterparty clearing, according to a new report…

Pimco said to be behind OTC clearing spike at CME

Interest rate swap clearing volumes at CME leapt 2,172% between August and September, and dealers say one firm is responsible for the surge

The Fed commitment letter process is alive and well, say Isda panellists

FSA's Bailey says the commitment letter process is better for firms than having the regulator "kicking over their books"

Rule could make OTC-cleared energy contracts 'endangered species': O’Malia

CFTC commissioner renews support for over-the-counter energy clearing tool in the face of new Dodd-Frank rules that could affect operation

Dealers move to secure derivatives clearing gateways in Asia

Courting counterparties

Shell Energy chief calls for regulatory data confidentiality rules

The confidentiality of energy trading data provided to regulators for market monitoring purposes continues to concern market players and regulators alike, after August leak by senator Sanders

OTC derivatives reform will lead to algo boom, banks predict

Dodd-Frank and Sefs set to encourage growth in algorithmic execution of OTC derivatives, say dealers

OTC flash crash: Dealers consider risks of HFT invasion

The fixed-income flash crash

A trust deficit: why regulators need to rely on each other

Trust, but verify

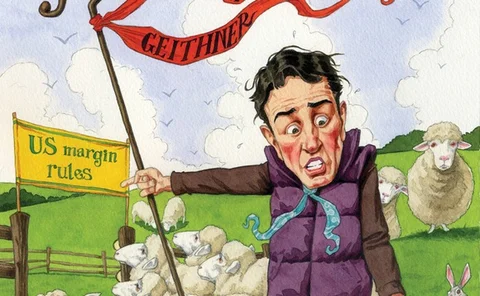

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

NYSE Liffe: one pot to rule them all

One pot to rule them all

LCH to become more commercially driven, says Axe

Commercially driven

Multiple repositories must adhere to common standards, says CPSS-Iosco

International coalition of regulators recognises the likelihood that multiple trade repositories will be set up along global, regional or national lines and sets out recommendations for minimum standards

Wave of new regulation brings inconsistencies and loopholes

Divergent paths

New proposals could take the sting out of Sefs, say industry experts

The appearance of the Sef Clarification Act last month, coupled with a changing mood in Washington, DC, has given rise to a more positive outlook among e-commerce experts

Risk waterfall at CME, Ice makes porting harder, dealers say

The need to provide portability could pressure CCPs to lean more heavily on initial margin than default funds to absorb losses