Options

Currency derivatives house of the year: UBS

Risk Awards 2025: Access to wealth management client base helped Swiss bank to recycle volatility and provide accurate pricing for a range of FX structures

Interest rate derivatives house of the year: JP Morgan

Risk Awards 2025: Steepener hedges and Spire novations helped clients navigate shifting rates regime

FX options: rising activity puts post-trade in focus

A surge in electronic FX options trading is among the factors fuelling demand for efficiencies across the entire trade lifecycle

Marex leapfrogs three FCMs with record F&O margin

New clients, trading activity surge and higher margin rates drive increase at UK broker

Option pricing under the normal stochastic alpha–beta–rho model with Gaussian quadratures

The authors integrate a Gaussian quadrature for option pricing under the normal alpha–beta–rho model, which they demonstrate to calculate accurate, arbitrage-free price and delta.

JPM sees upside in blurring lines between QIS and SMAs

Hedge funds are combining their strategies with bank indexes to create new products

Hedge funds pile into short volatility QIS options

New twist on capturing vol premium remains popular despite mixed performance in August vol spike

Chicago pits power IMC’s institutional options push

Talking Heads: IMCX lures 100 asset managers, while Dash partnership bolsters retail execution

Low FX vol regime fuels exotics expansion

Interest is growing in the products as a way to squeeze juice out of a flat market

August’s volatility thunderbolt rattles risk managers

Investment firms mull changes to value-at-risk models after never-before-seen spike in volatility index

Goldman Sachs retakes top FXO dealer spot with mutual funds

Counterparty Radar: Trades with SEI Investments boosts US bank to top spot

Morgan Stanley, Goldman FCMs set new margin records

Investment banks see futures, options and swaps margin hit new highs in September

Simm casts off Covid pain for $40 billion IM reprieve

Recalibration cuts risk weights in equity and commodities, but some credit exposures double on ABX halt

ASX member paid record $154m to cover dues in Q2

Single-member largest payment obligation beat 2015’s high by 40.8%

Crypto options need more principal market-makers – GS trader

Absence of risk warehousing market-makers holding back options development, says GS crypto trader

ETF dispersion set for election revival

Sector-based approach to popular vol trades boasts cheaper entry cost than classic version, proponents argue

Analyzing market sentiment based on the option-implied distribution of stock returns

The authors propose a means to assess market sentiment using the option-implied distribution of stock returns generated from option data, allowing for efficient optimization of complex portfolios.

Pre-market trades blamed for record Vix surge

Traders rushed to cover short vol positions before the market opened on August 5

Credit options notional for top US dealers soars 45.3%

Investor demand for puts and calls drives balances near Q1 2022 record

Citi, Barclays raise FCM target residual interest 28% in June

Backstop funds also marginally up as a proportion of required customer funds

Dealers bruised by surprise renminbi vol surge

Rush to re-hedge USD/CNH exotics left banks in grip of painful short gamma squeeze

After the selloff, competing theories on dealer gamma

Tier1 Alpha sees $74 billion short gamma catalyst; SG says rapid return to positive territory had calming effect

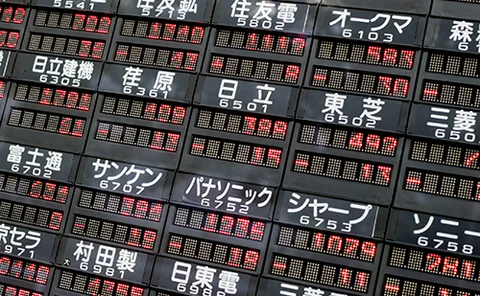

Vega peak was foothill in historic Nikkei selloff

JFSA scrutiny has curbed issuance of autocallables, so stock plunge generated light re-hedging

Barclays overtakes BofA on client margin for swaps

July figures make FCM fifth-largest by total margin in the US