Operational risk

WHAT IS THIS? Operational risks are those arising from people, processes and systems – the biggest form of exposure for many industries, but one that was neglected by financial firms until the collapse of Barings Bank in 1995. It was added to the Basel capital framework in 2004, but attempts to model operational risk were dealt a heavy blow by the huge, unforeseen losses suffered by banks in the aftermath of the financial crisis.

Belgian companies club together for op risk guide

Five Belgian financial services providers have partnered with PricewaterhouseCoopers to release a set of guidelines for measuring operational risk management.

New report blames op risk failures for sub-prime meltdown

Op risk: a culprit in sub-prime mortgage crisis

Future options

Operational risk derivatives have been touted for a few years now, but interest in them moves in waves. The current tide is high, however. Duncan Wood tests the water

Defining the boundaries

PROFILE: HIM CHUAN LIM

The principles of distribution fitting

TECHNICAL

What to do with the treasure we've found?

This month, I've quite literally been around the world checking on the state of the operational risk industry. From my base in London, I've been to our conferences in both Singapore and New York.

Room for improvement

Sungard tops our survey of software vendors, its products proving a hit across the op risk and compliance spectrum. But op risk executives continue to demand more from the software industry, reports Dianne See Morrison

Decoding the data

With less than six months to go before Mifid takes effect, banks need to address the data-storage and management requirements they will face. Duncan Wood reports

KRIs: that difficult age

Key risk indicators (KRIs) were once the golden child of operational risk, but they are now in the midst of a turbulent adolescence. Peter Madigan asks whether KRIs will start to grow up in the next couple of years

From small acorns...

In the third of a series, Eric Holmquist considers some practical steps to building a better risk culture

Dealing with the rise of Web 2.0

The rise of Web 2.0 may seem in some ways to be a subject rather remote to the normal concerns of an op risk or compliance executive.

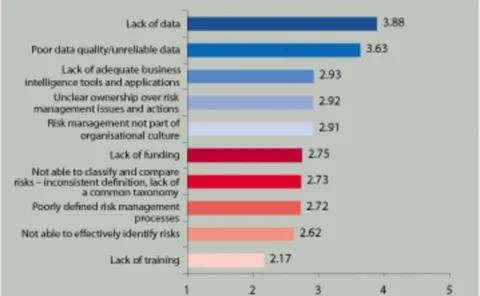

Untangling the risk information knot

In a new OpRisk & Compliance Intelligence survey, sponsored by BearingPoint Management & Technology Consultants, data issues rank high on the risk executive's list of problems. Can Web 2.0 change the face of risk information collection?

A question of discipline

Op risk is showing signs of maturing, although there is still much work to be done. So delivering value to the business continues to be a substantial challenge, according to a new survey

Profile: Joe Sabatini and the rules of engagement

The guiding principles of Basel II are now shrouded in mists of regulatory detail, says JP Morgan's Joe Sabatini. He tells Duncan Wood op risk managers must now look beyond mere compliance, and focus on adding value to their firms

Changing culture

In the second of a series, Eric Holmquist considers some specific goals in trying to establish a risk culture

Keeping pace with a changing industry

Welcome to the 'new look' OpRisk & Compliance magazine. As many of our long-time readers will know, OpRisk & Compliance has come a long way over the past few years – we are working hard to keep up with the rapid evolution of the disciplines of…