Operational risk data

Ready for anything?

Top OR&C 2009 risks

All under control

Jeff Roth and Wally Musegades outline how it is possible to reduce exposure through active control management, and for the op risk function to make a positive contribution to business results

Naked to the extreme

Extreme Events

Measures for measures

Consistent quantitative operational risk measurement is vital to the health of banks and financial institutions. Andreas Jobst offers guidance on enhanced market practice and risk measurement standards

A narrowing gulf

Many Middle Eastern nations are keen to implement Basel II, and larger banks have been stepping up efforts to develop an op risk framework. But smaller banks are being hindered by a shortage of resources and experienced staff, as Victoria Pennington…

The data puddle challenge

The loss event taxonomies currently in use are inadequate. The worst problem is the lack of clarity with regard to the boundary conditions between risk event categories. Tara McLenaghen explores the issues

Risk information: science or art?

Industry experts gathered for a roundtable discussion in New York at the end of May to debate the ways firms acquire and use information about risks. Moderated by Ellen Davis

Future options

Operational risk derivatives have been touted for a few years now, but interest in them moves in waves. The current tide is high, however. Duncan Wood tests the water

Room for improvement

Sungard tops our survey of software vendors, its products proving a hit across the op risk and compliance spectrum. But op risk executives continue to demand more from the software industry, reports Dianne See Morrison

Untangling the risk information knot

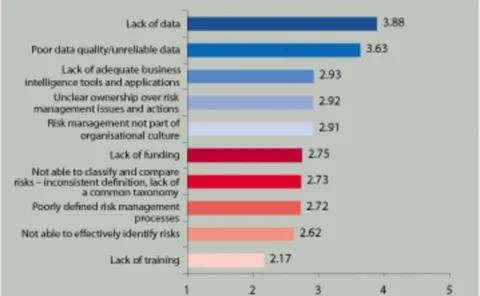

In a new OpRisk & Compliance Intelligence survey, sponsored by BearingPoint Management & Technology Consultants, data issues rank high on the risk executive's list of problems. Can Web 2.0 change the face of risk information collection?

A question of discipline

Op risk is showing signs of maturing, although there is still much work to be done. So delivering value to the business continues to be a substantial challenge, according to a new survey

Profile: Joe Sabatini and the rules of engagement

The guiding principles of Basel II are now shrouded in mists of regulatory detail, says JP Morgan's Joe Sabatini. He tells Duncan Wood op risk managers must now look beyond mere compliance, and focus on adding value to their firms

Two heads are better than one

Glenn Christensen of Synovus Financial Corp. introduces an enterprise risk management strategy known as the Bifurcated ERM Methodology

Resolving the confusion

Risk control self-assessments have become a Tower of Babel for the op risk discipline, with a variety of different approaches being taken. Ellen Davis reports

Time for change

Implementation of the core principles of op risk still has a long way to go in the Asia-Pacific region. Ellen Davis reports

Event horizon

Rick Cech takes a second look at what makes up operational risk event types, and asks if there is a more advanced way to define them

Looking into the crystal ball

Eric Holmquist presents some observations on the trends in ORM, and offers predictions on what to expect in 2007 and beyond

The advancing tide of rationalisation

Rationalisation, rationalisation, rationalisation. There is no denying it, this is the major theme in operational risk in the US at the moment, and it is a trend that is spreading to Europe as well.